Blank Profit And Loss Form

Understanding the Profit and Loss form is essential for anyone involved in managing a business's finances. This document serves as a financial snapshot, outlining the revenues, costs, and expenses incurred during a specific period. By analyzing this form, business owners can gauge their profitability and make informed decisions about future operations. Key components include total income, which reflects all earnings generated from sales or services, and various expenses, which encompass everything from operating costs to taxes. The net profit or loss, derived from subtracting total expenses from total income, provides crucial insight into the financial health of the business. Regularly reviewing this form not only aids in tracking performance but also helps in identifying trends and potential areas for improvement. In a competitive market, having a clear understanding of your Profit and Loss statement can be the difference between success and failure.

More PDF Forms

Immigration Forms - A signed I-864 must be submitted for each family member applying for residency.

When engaging in the buying or selling of a boat, it is crucial to utilize the proper documentation, such as the California Boat Bill of Sale. This legal form not only provides proof of ownership transfer but also helps to clarify transaction details, ensuring that both parties are protected. To facilitate this process, you may refer to the Vessel Bill of Sale, which serves as an excellent resource for creating the necessary documentation and adhering to state regulations.

Gf Applications - Ready to find someone to cherish openly and sincerely.

Dos and Don'ts

When filling out the Profit and Loss form, it is essential to approach the task with care and attention. Here are some key guidelines to consider:

- Do: Ensure all income sources are accurately reported. This includes sales revenue, investment income, and any other earnings.

- Do: Categorize expenses clearly. Group similar expenses together for better clarity and analysis.

- Do: Use the most recent financial data available. This will provide a more accurate picture of your business's performance.

- Do: Review the form for errors before submission. Double-checking can prevent costly mistakes.

- Don't: Overlook minor expenses. Small costs can add up and impact your overall profit.

- Don't: Ignore the importance of consistency. Use the same accounting methods throughout to ensure comparability over time.

Profit And Loss Sample

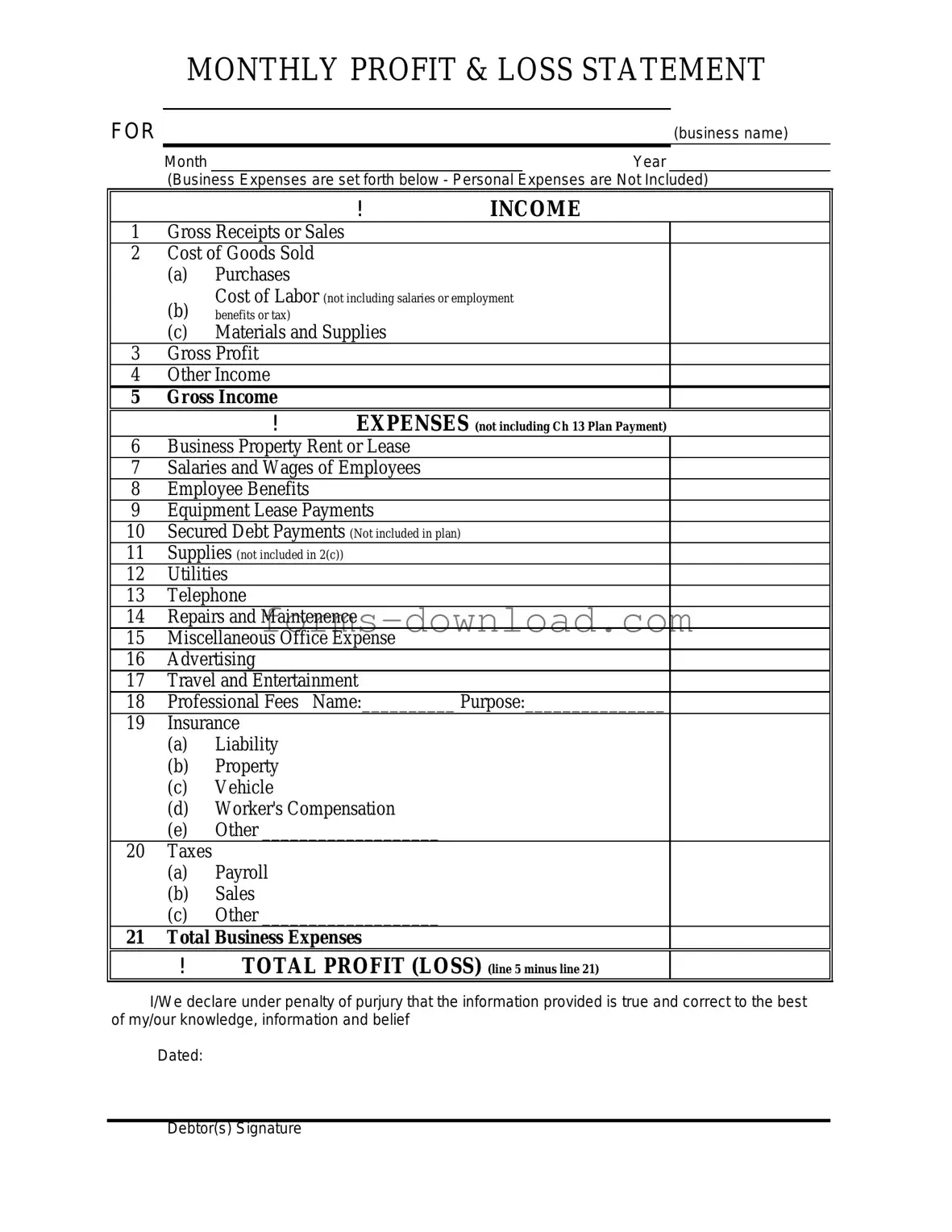

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature

Listed Questions and Answers

-

What is a Profit and Loss form?

A Profit and Loss form, also known as an income statement, is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period of time. It provides insight into a company's ability to generate profit by comparing revenue against expenses.

-

Why is the Profit and Loss form important?

The Profit and Loss form is essential for understanding a business's financial health. It helps stakeholders, including management, investors, and creditors, evaluate profitability, assess operational efficiency, and make informed decisions regarding budgeting and investment.

-

What information is included in a Profit and Loss form?

The form typically includes the following sections:

- Revenue: Total income generated from sales or services.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs related to running the business, excluding COGS.

- Net Profit: The final profit after all expenses have been deducted from revenue.

-

How often should a Profit and Loss form be prepared?

A Profit and Loss form can be prepared monthly, quarterly, or annually, depending on the needs of the business. Regular preparation allows for timely analysis of financial performance and aids in identifying trends over time.

-

Who prepares the Profit and Loss form?

The Profit and Loss form is typically prepared by the accounting department or a designated accountant. In smaller businesses, the owner may take on this responsibility, especially if they manage their own financial records.

-

Can the Profit and Loss form be used for tax purposes?

Yes, the Profit and Loss form can be used for tax purposes. It provides a summary of income and expenses, which is necessary for calculating taxable income. However, it is important to ensure that the form complies with applicable tax regulations.

-

What is the difference between Profit and Loss and a Balance Sheet?

The Profit and Loss form focuses on income and expenses over a specific period, showing how much money was made or lost. In contrast, a Balance Sheet provides a snapshot of a company's assets, liabilities, and equity at a specific point in time, illustrating the overall financial position of the business.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Profit and Loss form is used to summarize a business's revenues, costs, and expenses over a specific period, typically a fiscal quarter or year. |

| Components | This form includes sections for gross revenue, operating expenses, and net profit or loss, providing a clear financial overview. |

| Importance | It helps business owners and stakeholders assess financial performance and make informed decisions regarding operations and investments. |

| State-Specific Forms | Many states have their own Profit and Loss forms that comply with local regulations. For example, California requires adherence to the California Corporations Code. |

| Filing Frequency | Businesses typically prepare this form on a quarterly or annual basis, depending on their reporting requirements and financial practices. |

| Review Process | Accountants or financial analysts often review the Profit and Loss form to ensure accuracy and compliance with accounting standards. |