Fillable Promissory Note Form

A promissory note is a critical financial document that serves as a written promise to pay a specified amount of money to a designated party at a predetermined date or on demand. This form includes essential details such as the names of the borrower and lender, the principal amount, interest rate, payment schedule, and any collateral involved. It also outlines the consequences of default, providing clarity on the rights and obligations of both parties. By clearly stating these terms, a promissory note helps to prevent misunderstandings and disputes that may arise during the repayment process. This straightforward instrument is commonly used in various financial transactions, including personal loans, business loans, and real estate financing. Understanding the components of a promissory note can empower individuals and businesses to engage in lending and borrowing with confidence.

Promissory NoteTemplates for Particular US States

Promissory Note Subtypes

Popular Forms:

Liability Waiver Form for Personal Trainers - Signing this form indicates understanding of potential injuries from training.

When engaging in the sale of a vessel, it's imperative to utilize the Bill of Sale for a Boat to facilitate the process, ensuring all legalities are met and both parties are protected during the transfer of ownership.

Life Estate Deed Sample - The form is designed to provide a straightforward method for property transfer without additional costs.

Dos and Don'ts

When filling out a Promissory Note form, it's important to follow certain guidelines to ensure clarity and legality. Here are some dos and don'ts to keep in mind:

- Do include the full names and addresses of all parties involved.

- Do specify the amount of money being borrowed clearly.

- Do outline the repayment terms, including interest rates and due dates.

- Do sign and date the document in the presence of a witness or notary.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to keep a copy of the signed note for your records.

- Don't overlook the importance of legal advice if the amount is substantial.

- Don't leave any sections blank; fill in all required information.

Promissory Note Sample

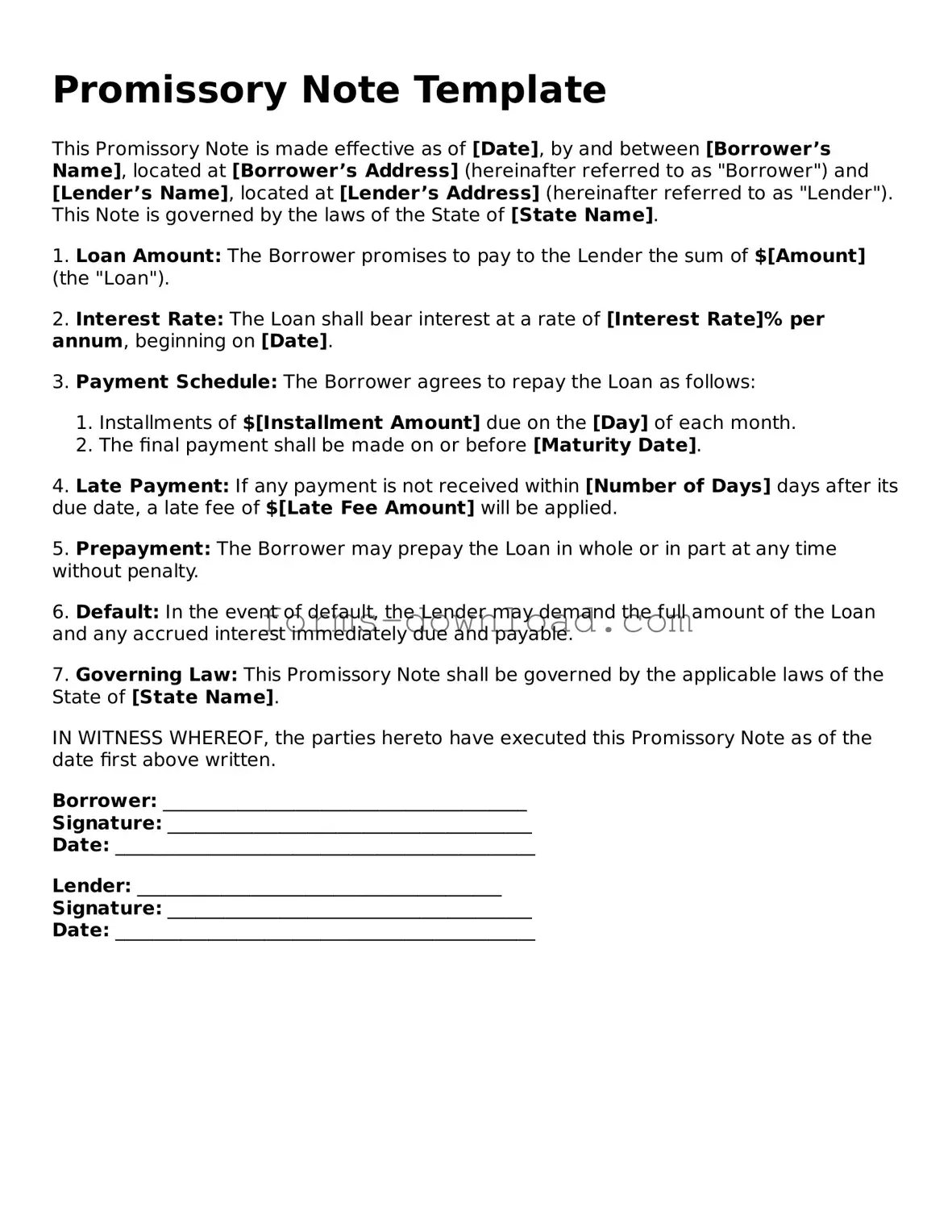

Promissory Note Template

This Promissory Note is made effective as of [Date], by and between [Borrower’s Name], located at [Borrower’s Address] (hereinafter referred to as "Borrower") and [Lender’s Name], located at [Lender’s Address] (hereinafter referred to as "Lender"). This Note is governed by the laws of the State of [State Name].

1. Loan Amount: The Borrower promises to pay to the Lender the sum of $[Amount] (the "Loan").

2. Interest Rate: The Loan shall bear interest at a rate of [Interest Rate]% per annum, beginning on [Date].

3. Payment Schedule: The Borrower agrees to repay the Loan as follows:

- Installments of $[Installment Amount] due on the [Day] of each month.

- The final payment shall be made on or before [Maturity Date].

4. Late Payment: If any payment is not received within [Number of Days] days after its due date, a late fee of $[Late Fee Amount] will be applied.

5. Prepayment: The Borrower may prepay the Loan in whole or in part at any time without penalty.

6. Default: In the event of default, the Lender may demand the full amount of the Loan and any accrued interest immediately due and payable.

7. Governing Law: This Promissory Note shall be governed by the applicable laws of the State of [State Name].

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the date first above written.

Borrower: _______________________________________

Signature: _______________________________________

Date: _____________________________________________

Lender: _______________________________________

Signature: _______________________________________

Date: _____________________________________________

Listed Questions and Answers

-

What is a Promissory Note?

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a legal document that outlines the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments.

-

Who uses a Promissory Note?

Individuals, businesses, and financial institutions commonly use promissory notes. For example, when a friend lends money to another friend, they might use a promissory note to formalize the loan. Businesses may also issue promissory notes when borrowing funds from investors or banks.

-

What are the key components of a Promissory Note?

A promissory note typically includes:

- The names and addresses of the borrower and lender

- The principal amount borrowed

- The interest rate, if applicable

- The repayment schedule, including due dates

- Any collateral securing the loan

- Consequences of default or late payment

-

Is a Promissory Note legally binding?

Yes, a promissory note is legally binding as long as it meets certain requirements. Both parties must agree to the terms, and the note must be signed by the borrower. It is advisable to have the document notarized to strengthen its enforceability.

-

Can a Promissory Note be modified?

Yes, a promissory note can be modified if both the borrower and lender agree to the changes. It is important to document any modifications in writing and have both parties sign the amended note to ensure clarity and legality.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or pursuing collection efforts. The specific consequences should be outlined in the promissory note itself.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Parties Involved | The two main parties are the maker (borrower) and the payee (lender). |

| Governing Law | In the U.S., promissory notes are generally governed by the Uniform Commercial Code (UCC), which varies by state. |

| Essential Elements | A valid promissory note includes the amount, interest rate, payment schedule, and signatures of the parties. |

| Interest Rates | Interest rates can be fixed or variable and must comply with state usury laws. |

| Transferability | Promissory notes can often be transferred or sold to another party, which is known as endorsement. |

| Default Consequences | If the maker fails to pay, the payee can pursue legal action to recover the owed amount. |

| State-Specific Forms | Some states may have specific forms or requirements; always check local laws. |

| Record Keeping | It is essential to keep a copy of the promissory note for personal records and future reference. |