Fillable Promissory Note for a Car Form

When purchasing a car, especially when financing it through a private sale, a Promissory Note for a Car serves as a crucial document that outlines the agreement between the buyer and the seller. This form details the amount borrowed, the interest rate, and the repayment schedule, ensuring both parties are on the same page regarding the financial terms of the transaction. It typically includes essential information such as the names and addresses of both the buyer and the seller, a description of the vehicle, and any specific conditions tied to the loan. By clearly stating the obligations of the borrower, the Promissory Note protects the seller's interests while providing the buyer with a structured plan to repay the loan. Additionally, this document can serve as a legal record, making it easier to resolve any disputes that may arise in the future. Understanding the components of this form is vital for anyone looking to navigate the complexities of car financing effectively.

More Promissory Note for a Car Forms:

Promissory Note Release - Used to maintain proper legal documentation in financial matters.

When entering into a loan agreement, it's essential to have a clear understanding of the terms and conditions outlined in the Promissory Note, as this document serves as a vital tool for both parties involved, ensuring that obligations are met and expectations are aligned.

Dos and Don'ts

When filling out a Promissory Note for a Car, it's important to get it right. Here are some things to keep in mind:

- Do: Read the entire form carefully before you start filling it out.

- Do: Clearly state the amount of money being borrowed and the interest rate.

- Do: Include the names and addresses of both the borrower and the lender.

- Do: Specify the payment schedule, including due dates and amounts.

- Do: Sign and date the document to make it legally binding.

- Don't: Leave any blank spaces on the form; this can lead to confusion.

- Don't: Use vague language; be specific about terms and conditions.

- Don't: Forget to keep a copy for your records after signing.

- Don't: Rush through the process; take your time to ensure accuracy.

- Don't: Ignore state laws that may affect the terms of the note.

Promissory Note for a Car Sample

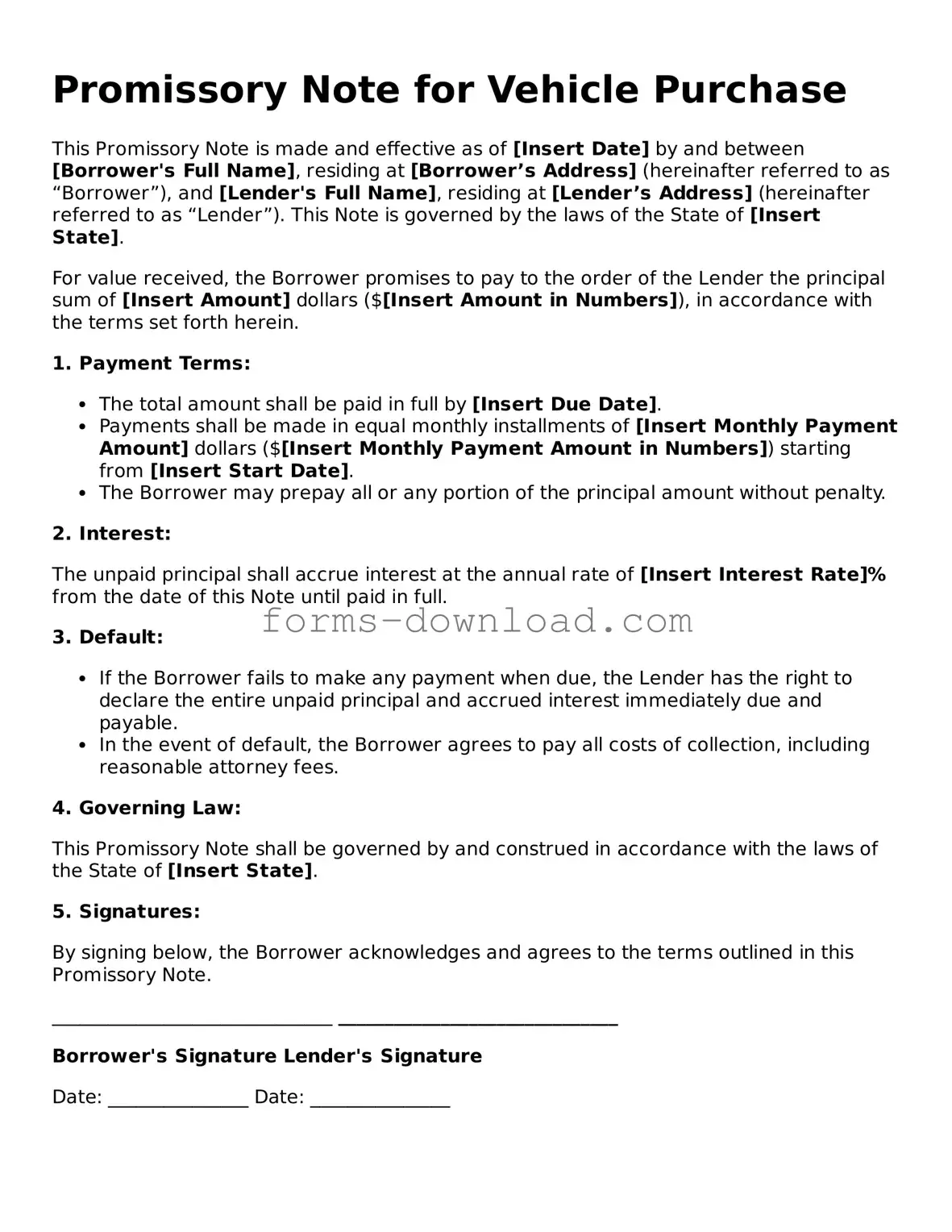

Promissory Note for Vehicle Purchase

This Promissory Note is made and effective as of [Insert Date] by and between [Borrower's Full Name], residing at [Borrower’s Address] (hereinafter referred to as “Borrower”), and [Lender's Full Name], residing at [Lender’s Address] (hereinafter referred to as “Lender”). This Note is governed by the laws of the State of [Insert State].

For value received, the Borrower promises to pay to the order of the Lender the principal sum of [Insert Amount] dollars ($[Insert Amount in Numbers]), in accordance with the terms set forth herein.

1. Payment Terms:

- The total amount shall be paid in full by [Insert Due Date].

- Payments shall be made in equal monthly installments of [Insert Monthly Payment Amount] dollars ($[Insert Monthly Payment Amount in Numbers]) starting from [Insert Start Date].

- The Borrower may prepay all or any portion of the principal amount without penalty.

2. Interest:

The unpaid principal shall accrue interest at the annual rate of [Insert Interest Rate]% from the date of this Note until paid in full.

3. Default:

- If the Borrower fails to make any payment when due, the Lender has the right to declare the entire unpaid principal and accrued interest immediately due and payable.

- In the event of default, the Borrower agrees to pay all costs of collection, including reasonable attorney fees.

4. Governing Law:

This Promissory Note shall be governed by and construed in accordance with the laws of the State of [Insert State].

5. Signatures:

By signing below, the Borrower acknowledges and agrees to the terms outlined in this Promissory Note.

______________________________ ______________________________

Borrower's Signature Lender's Signature

Date: _______________ Date: _______________

Listed Questions and Answers

-

What is a Promissory Note for a Car?

A Promissory Note for a Car is a written agreement between a borrower and a lender. In this document, the borrower promises to repay a specified amount of money to the lender, typically for the purchase of a vehicle. This note outlines the terms of the loan, including the interest rate, payment schedule, and any penalties for late payments. It serves as a legal record of the debt and can be enforced in court if necessary.

-

What information is typically included in a Promissory Note for a Car?

The Promissory Note generally contains several key pieces of information:

- The names and addresses of both the borrower and the lender.

- The amount of the loan, which is the total price of the car minus any down payment.

- The interest rate, which may be fixed or variable.

- The repayment schedule, detailing how often payments are due (e.g., monthly) and the duration of the loan.

- Consequences for defaulting on the loan, such as late fees or repossession of the vehicle.

-

Is a Promissory Note for a Car legally binding?

Yes, a Promissory Note is legally binding as long as it meets certain criteria. Both parties must agree to the terms, and the document must be signed by the borrower. In some cases, having a witness or notarization can strengthen its enforceability. If the borrower fails to make payments as agreed, the lender can take legal action to recover the owed amount, including repossessing the vehicle.

-

Can a Promissory Note for a Car be modified after it is signed?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. This typically requires a written amendment that outlines the new terms. It is advisable to document any modifications to avoid confusion or disputes in the future. If the changes are significant, both parties may also consider re-signing a new Promissory Note to reflect the updated agreement.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount of money for the purchase of a vehicle. |

| Parties Involved | The note typically involves the borrower (buyer) and the lender (seller or financial institution). |

| Governing Law | In the United States, the laws governing promissory notes can vary by state, often falling under the Uniform Commercial Code (UCC). |

| Payment Terms | The note outlines the payment schedule, including the amount, frequency, and due dates for payments. |

| Interest Rate | The document specifies any interest rates applicable to the loan amount, which may be fixed or variable. |

| Default Consequences | If the borrower fails to make payments, the lender may have the right to repossess the vehicle or take legal action. |