Fillable Release of Promissory Note Form

The Release of Promissory Note form serves an important function in financial transactions, particularly when a borrower has fulfilled their obligations under a loan agreement. This form acts as a formal acknowledgment that the lender has received full payment and, as a result, releases the borrower from any further obligations related to the promissory note. It typically includes key details such as the names of the parties involved, the date of the release, and information about the original promissory note, including its date and amount. Additionally, the form may require signatures from both the lender and borrower, ensuring that both parties agree to the release. By completing this form, borrowers can obtain proof that they have satisfied their debt, which can be crucial for their financial records and future transactions. Understanding the significance of this document can help individuals navigate the process of loan repayment and ensure that all necessary steps are taken to officially close out their financial responsibilities.

More Release of Promissory Note Forms:

Car Loan Promissory Note - This document is often a requirement for auto loans from financial institutions.

A promissory note in Alabama is a written promise to pay a specified amount of money to a designated party at a defined time. This legal document outlines the terms of the loan, including interest rates and repayment schedules. If you're looking to create a legally binding agreement, you can learn more and access the necessary form by visiting this Promissory Note.

Dos and Don'ts

When filling out the Release of Promissory Note form, it's important to follow certain guidelines to ensure accuracy and completeness. Here’s a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information about the parties involved.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use white-out or make alterations to the form.

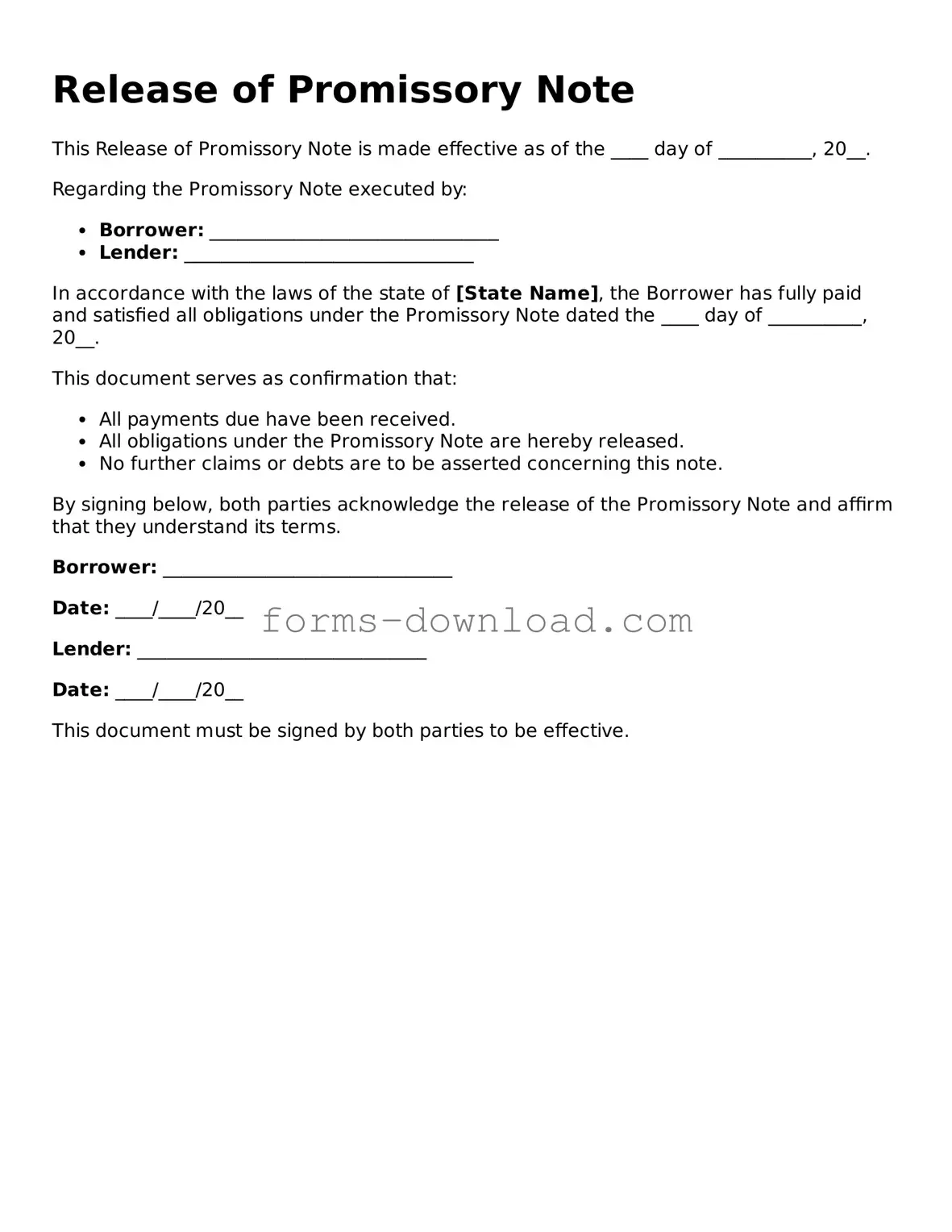

Release of Promissory Note Sample

Release of Promissory Note

This Release of Promissory Note is made effective as of the ____ day of __________, 20__.

Regarding the Promissory Note executed by:

- Borrower: _______________________________

- Lender: _______________________________

In accordance with the laws of the state of [State Name], the Borrower has fully paid and satisfied all obligations under the Promissory Note dated the ____ day of __________, 20__.

This document serves as confirmation that:

- All payments due have been received.

- All obligations under the Promissory Note are hereby released.

- No further claims or debts are to be asserted concerning this note.

By signing below, both parties acknowledge the release of the Promissory Note and affirm that they understand its terms.

Borrower: _______________________________

Date: ____/____/20__

Lender: _______________________________

Date: ____/____/20__

This document must be signed by both parties to be effective.

Listed Questions and Answers

-

What is a Release of Promissory Note form?

The Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note. This note typically represents a borrower's promise to repay a loan. When the loan is fully paid or otherwise settled, this form is used to officially release the borrower from their obligation.

-

Why is it important to complete this form?

Completing the Release of Promissory Note form is crucial for both the lender and borrower. For the borrower, it provides proof that the debt has been settled. For the lender, it protects their interests by documenting that the obligation has been fulfilled. This can prevent future disputes regarding the loan status.

-

Who needs to sign the form?

Typically, both the lender and the borrower must sign the Release of Promissory Note form. If there are co-borrowers or additional parties involved in the loan agreement, their signatures may also be required to ensure that all parties acknowledge the release.

-

What information is required on the form?

The form usually requires basic information such as the names of the parties involved, the date of the loan, the amount borrowed, and any relevant loan identification numbers. Additionally, it should include a statement confirming that the loan has been paid in full or otherwise settled.

-

How should the completed form be handled?

Once the Release of Promissory Note form is completed and signed, it should be distributed to all parties involved. Each party should keep a copy for their records. It may also be advisable to file the form with the appropriate local or state office, depending on jurisdictional requirements.

-

What happens if the form is not completed?

If the Release of Promissory Note form is not completed, the borrower may still be viewed as owing the debt. This can lead to complications in the future, including potential claims from the lender. It is essential to finalize this process to avoid misunderstandings and ensure clarity regarding the loan status.

-

Can this form be revoked after signing?

Generally, once the Release of Promissory Note form is signed and the debt is settled, it cannot be revoked. However, if there are any errors or misunderstandings, parties may need to consult legal counsel to address the situation. It is always best to ensure that all terms are clear and agreed upon before signing.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Release of Promissory Note form is used to formally document the cancellation of a promissory note, indicating that the borrower has fulfilled their repayment obligations. |

| Parties Involved | This form typically involves two parties: the lender, who originally issued the note, and the borrower, who is responsible for repayment. |

| Governing Law | The laws governing the release of promissory notes can vary by state. For example, in California, it is governed by the California Civil Code. |

| Signature Requirement | Both parties must sign the form to make it legally binding. This ensures that there is mutual agreement regarding the release. |

| Record Keeping | It is advisable for both parties to keep a copy of the signed Release of Promissory Note form for their records, as it serves as proof of the cancellation. |

| Timing | The release should be executed promptly after the borrower has made the final payment, to avoid any misunderstandings regarding the debt status. |

| Legal Effect | Once executed, the Release of Promissory Note form extinguishes the borrower's obligation to repay the loan, effectively releasing them from any further liability. |