Fillable Single-Member Operating Agreement Form

When establishing a single-member limited liability company (LLC), one crucial document that comes into play is the Single-Member Operating Agreement. This form serves as a foundational blueprint for the operation and management of the LLC, outlining key elements such as ownership structure, management responsibilities, and financial arrangements. It delineates the rights and obligations of the sole member, ensuring clarity in decision-making processes and providing guidance on how the company will be run. Additionally, this agreement can help protect the member's personal assets by reinforcing the separation between personal and business liabilities. By clearly defining operational procedures, such as how profits and losses will be handled, the agreement also sets the stage for future growth and potential transitions, whether that involves bringing in partners or selling the business. In essence, the Single-Member Operating Agreement not only formalizes the structure of the LLC but also serves as a vital tool for safeguarding the member's interests and enhancing the company's credibility in the eyes of banks, investors, and other stakeholders.

More Single-Member Operating Agreement Forms:

How to Write an Operating Agreement - Establishes procedures for member loans or financial assistance to the business.

To create a comprehensive foundation for your business, utilizing an Operating Agreement is crucial for LLCs in California. This vital document not only defines the roles and responsibilities of members but also addresses the financial agreements between them. For more information on how to tailor this essential form, you can visit https://californiapdf.com/editable-operating-agreement.

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, there are several important dos and don'ts to consider. Following these guidelines can help ensure that your agreement is clear and effective.

- Do provide accurate information about your business.

- Do clearly state the purpose of your business.

- Do outline the management structure and decision-making process.

- Do include provisions for amending the agreement in the future.

- Don't leave any sections blank; fill out every required part.

- Don't use vague language; be specific about your intentions.

By following these dos and don'ts, you can create a solid foundation for your business operations.

Single-Member Operating Agreement Sample

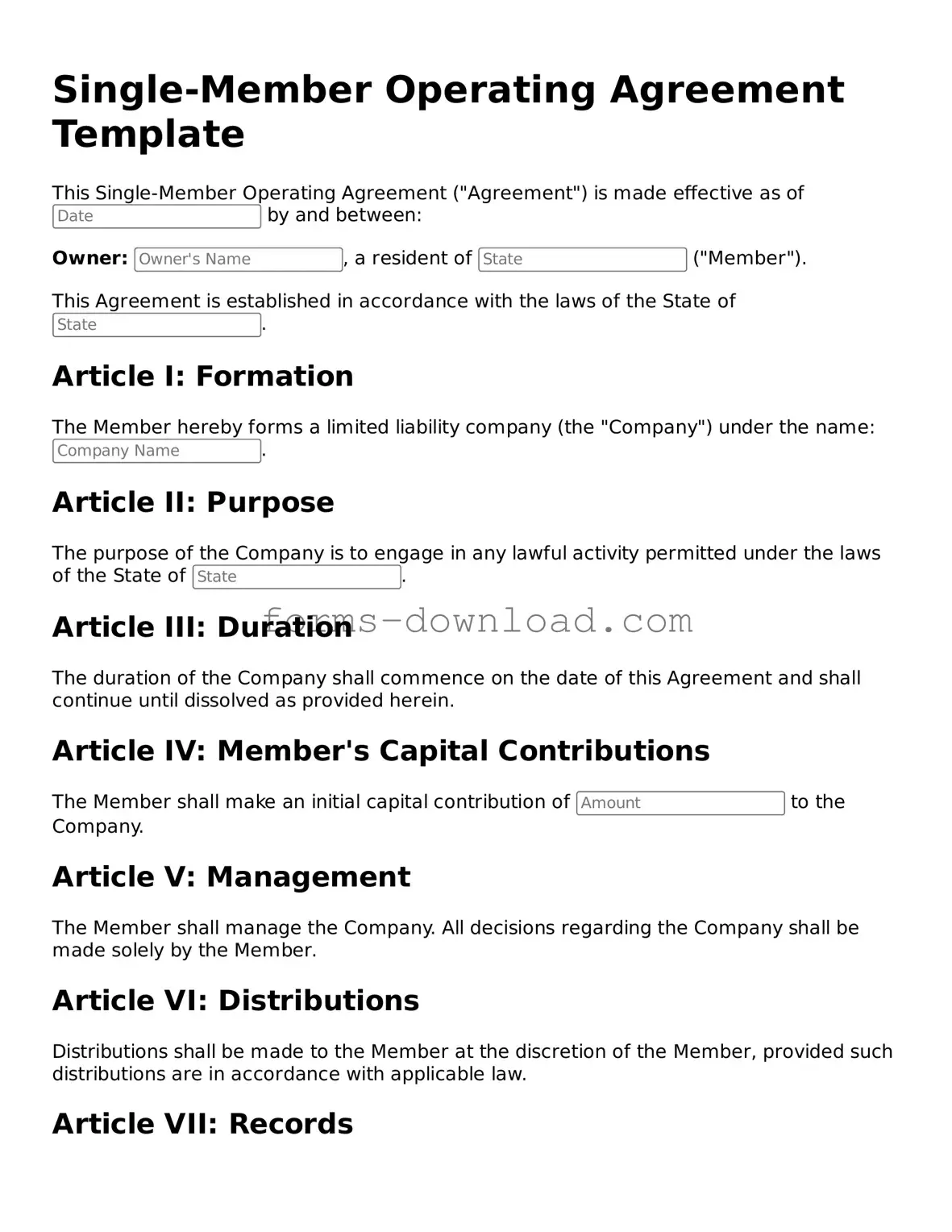

Single-Member Operating Agreement Template

This Single-Member Operating Agreement ("Agreement") is made effective as of by and between:

Owner: , a resident of ("Member").

This Agreement is established in accordance with the laws of the State of .

Article I: Formation

The Member hereby forms a limited liability company (the "Company") under the name: .

Article II: Purpose

The purpose of the Company is to engage in any lawful activity permitted under the laws of the State of .

Article III: Duration

The duration of the Company shall commence on the date of this Agreement and shall continue until dissolved as provided herein.

Article IV: Member's Capital Contributions

The Member shall make an initial capital contribution of to the Company.

Article V: Management

The Member shall manage the Company. All decisions regarding the Company shall be made solely by the Member.

Article VI: Distributions

Distributions shall be made to the Member at the discretion of the Member, provided such distributions are in accordance with applicable law.

Article VII: Records

The Company shall maintain complete and accurate books and records of the Company's business and affairs.

Article VIII: Indemnification

The Company shall indemnify the Member from any losses, claims, damages, or liabilities incurred as a result of their role as Member.

Article IX: Amendment

This Agreement may only be amended by a written agreement signed by the Member.

Article X: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of .

IN WITNESS WHEREOF, the Member has executed this Agreement as of the date first above written.

_________________________

Owner's Signature:

Date:

Listed Questions and Answers

-

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the management structure and operational guidelines for a single-member Limited Liability Company (LLC). This agreement serves as the foundational document for the LLC, detailing how the business will be run, the responsibilities of the owner, and how profits and losses will be handled.

-

Why do I need a Single-Member Operating Agreement?

Even as a sole owner, having an Operating Agreement is crucial. It provides clarity on your business operations and helps protect your personal assets from business liabilities. Additionally, it can be beneficial in establishing credibility with banks and investors, and it may be required by some states for LLC formation.

-

What should be included in a Single-Member Operating Agreement?

Key elements to include are:

- The name and address of the LLC

- The purpose of the LLC

- The owner’s name and contact information

- Details on how profits and losses will be distributed

- Procedures for adding or removing members, if applicable

- Management structure and decision-making processes

- Provisions for dissolution of the LLC

-

How does a Single-Member Operating Agreement affect taxes?

A Single-Member LLC is typically treated as a disregarded entity for tax purposes. This means that the income and expenses of the LLC are reported on your personal tax return. However, having an Operating Agreement can help clarify how profits and losses are handled, potentially simplifying your tax filings. It’s advisable to consult with a tax professional to understand the implications fully.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement outlines the management structure and operational procedures for a single-member LLC. |

| Importance | This document helps establish the LLC as a separate legal entity, protecting personal assets from business liabilities. |

| Governing Law | The agreement is governed by state law, which varies by state. For example, in Delaware, the Delaware Limited Liability Company Act applies. |

| Flexibility | The agreement allows the owner to customize management roles and operational procedures to fit their specific business needs. |

| Tax Treatment | A single-member LLC is typically treated as a disregarded entity for tax purposes, meaning profits and losses are reported on the owner's personal tax return. |