Blank Stock Transfer Ledger Form

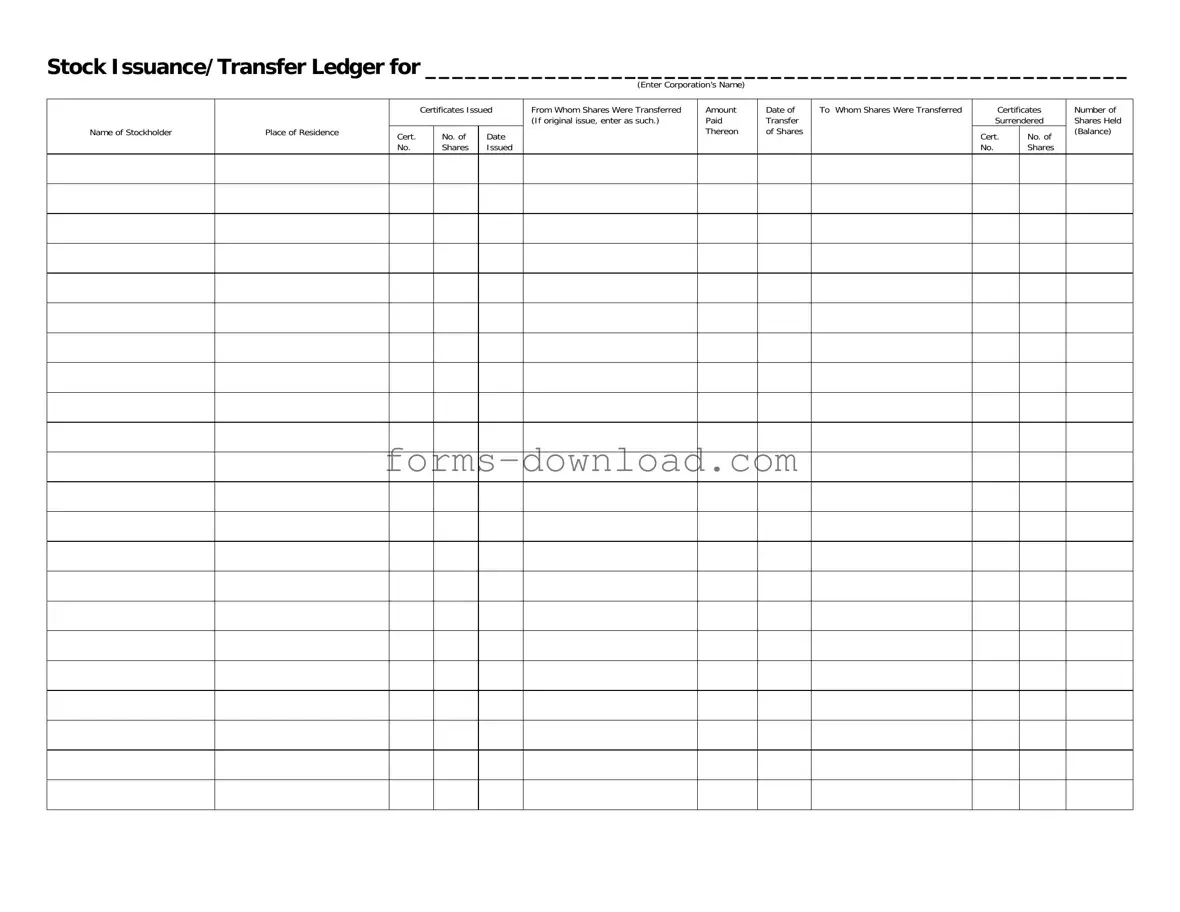

The Stock Transfer Ledger form is a crucial document for corporations managing their stock issuance and transfers. This form captures essential information about stockholders, including their names and places of residence, ensuring accurate record-keeping. It lists the certificates issued, detailing the certificate numbers, the dates of issuance, and the number of shares involved. When shares are transferred, the form notes from whom they were transferred, allowing for a clear chain of ownership. If the shares are part of an original issue, this is also indicated. The amount paid for the shares is documented, along with the date of the transfer. Additionally, the form specifies to whom the shares were transferred and the certificates that have been surrendered. Finally, it concludes with a balance of the number of shares held by the stockholder, providing a comprehensive overview of stock ownership within the corporation.

More PDF Forms

Is a Gift Letter Legally Binding - It's crucial to keep a copy of the Gift Letter with other mortgage documentation.

In addition to filling out the necessary documents, it is important for both the buyer and seller to understand the significance of having a proper record of the transaction, which can be accomplished by using the Bill of Sale for a Boat. This document not only protects both parties but also simplifies the transfer process, ensuring that all pertinent details are captured accurately.

Judge May Continue Criminal Charges Against - One signed motion can lead to a more favorable outcome in a legal dispute.

Dos and Don'ts

When filling out the Stock Transfer Ledger form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do enter the corporation's name clearly at the top of the form.

- Do provide accurate information for each stockholder, including their place of residence.

- Do ensure that the certificate numbers and dates are filled in correctly.

- Do indicate the number of shares issued and transferred without any omissions.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Don't use abbreviations or shorthand that may confuse the reader.

- Don't forget to double-check the amount paid for the shares to avoid discrepancies.

Stock Transfer Ledger Sample

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Listed Questions and Answers

-

What is a Stock Transfer Ledger form?

The Stock Transfer Ledger form is a document used to record the issuance and transfer of stock within a corporation. It helps keep track of who owns shares, how many shares have been issued, and any transfers that occur. This form is essential for maintaining accurate records of stock ownership.

-

What information do I need to fill out on the form?

When completing the Stock Transfer Ledger form, you will need to provide several key pieces of information:

- The name of the corporation.

- The name of the stockholder.

- The place of residence of the stockholder.

- The certificates issued, including certificate numbers and dates.

- The number of shares issued and the amount paid for them.

- The date of transfer and to whom the shares were transferred.

- The certificates surrendered and the balance of shares held.

-

Why is it important to keep an accurate Stock Transfer Ledger?

Maintaining an accurate Stock Transfer Ledger is crucial for several reasons. First, it provides a clear record of ownership, which is essential for any legal or financial matters. Second, it helps prevent disputes among stockholders regarding ownership and transfers. Finally, it ensures compliance with state and federal regulations regarding corporate governance.

-

Who is responsible for maintaining the Stock Transfer Ledger?

The responsibility for maintaining the Stock Transfer Ledger typically falls on the corporation’s secretary or a designated officer. This person must ensure that all transfers and issuances are accurately recorded and that the ledger is kept up to date.

-

What happens if I lose my stock certificate?

If a stock certificate is lost, it is important to notify the corporation immediately. The corporation may require you to complete a lost certificate affidavit and possibly pay a fee to issue a replacement certificate. Keeping the Stock Transfer Ledger updated will help facilitate this process.

-

Can I make changes to the Stock Transfer Ledger after it has been filled out?

Changes to the Stock Transfer Ledger should be made with caution. If an error is discovered, it is best to correct it by adding a note or an amendment rather than crossing out information. This ensures that a clear record of ownership is maintained. Always consult with the corporation’s secretary or legal counsel before making any changes.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form is used to document the issuance and transfer of stock shares in a corporation. |

| Information Required | It requires details such as the corporation's name, stockholder's name, place of residence, certificates issued, and the number of shares involved. |

| Transfer Details | The form includes sections for the date of transfer, the party from whom shares were transferred, and the party to whom shares were transferred. |

| Surrender of Certificates | When shares are transferred, the original certificates must be surrendered, which is noted on the form. |

| State-Specific Requirements | Different states may have specific laws governing stock transfers, such as the Delaware General Corporation Law for corporations in Delaware. |

| Balance Tracking | The form helps in tracking the number of shares held by each stockholder after transfers, ensuring accurate records are maintained. |