Attorney-Approved Durable Power of Attorney Document for the State of Tennessee

When it comes to planning for the future and ensuring that your wishes are honored, a Tennessee Durable Power of Attorney (DPOA) form is an essential tool. This legal document allows you to designate someone you trust—often referred to as your agent—to make decisions on your behalf if you become unable to do so yourself. The DPOA is particularly powerful because it remains effective even if you become incapacitated, providing peace of mind for both you and your loved ones. In Tennessee, the form outlines the specific powers granted to your agent, which can include managing your finances, handling real estate transactions, and making healthcare decisions. It's crucial to understand that the authority you give your agent can be tailored to meet your unique needs, allowing you to specify exactly what decisions they can make. Additionally, the DPOA can be revoked at any time as long as you are still competent, giving you control over your affairs. Understanding the nuances of this document can empower you to make informed choices about your future and ensure that your preferences are respected.

Consider More Durable Power of Attorney Templates for Different States

Types of Power of Attorney Virginia - You can revoke a Durable Power of Attorney at any time while you are still competent.

Durable Power of Attorney Florida Pdf - A Durable Power of Attorney can be tailored to meet specific needs and preferences.

A Power of Attorney form is a legal document that grants one person the authority to act on behalf of another in various matters, such as financial decisions or healthcare choices. For those looking to create this important legal arrangement, a comprehensive Power of Attorney form can be invaluable. This document empowers individuals to delegate important responsibilities, ensuring that their interests are managed even when they cannot make decisions themselves. Understanding how this form works is crucial for anyone considering delegation of authority to ensure their preferences and needs are respected.

How to Sign a Power of Attorney - This document plays a vital role in your overall financial planning strategy.

Dos and Don'ts

When filling out the Tennessee Durable Power of Attorney form, it is essential to approach the task carefully. Here are four important do's and don'ts to keep in mind:

- Do ensure that you understand the powers you are granting. Clearly define what decisions your agent can make on your behalf.

- Do choose a trustworthy person as your agent. This individual should act in your best interest and be someone you can rely on.

- Don't leave any sections of the form blank. Incomplete forms can lead to confusion or disputes later on.

- Don't forget to sign and date the form in the presence of a notary public. This step is crucial for the document to be legally valid.

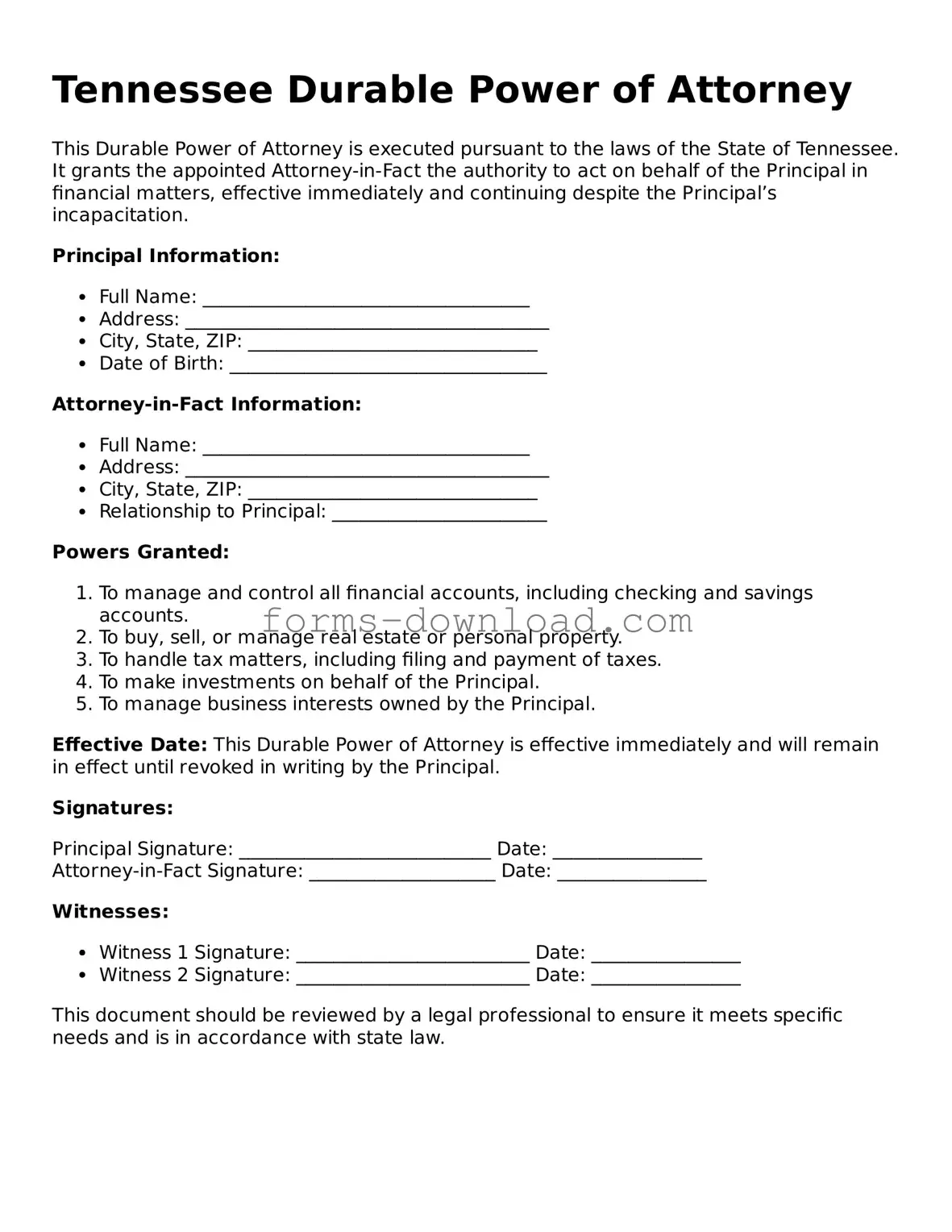

Tennessee Durable Power of Attorney Sample

Tennessee Durable Power of Attorney

This Durable Power of Attorney is executed pursuant to the laws of the State of Tennessee. It grants the appointed Attorney-in-Fact the authority to act on behalf of the Principal in financial matters, effective immediately and continuing despite the Principal’s incapacitation.

Principal Information:

- Full Name: ___________________________________

- Address: _______________________________________

- City, State, ZIP: _______________________________

- Date of Birth: __________________________________

Attorney-in-Fact Information:

- Full Name: ___________________________________

- Address: _______________________________________

- City, State, ZIP: _______________________________

- Relationship to Principal: _______________________

Powers Granted:

- To manage and control all financial accounts, including checking and savings accounts.

- To buy, sell, or manage real estate or personal property.

- To handle tax matters, including filing and payment of taxes.

- To make investments on behalf of the Principal.

- To manage business interests owned by the Principal.

Effective Date: This Durable Power of Attorney is effective immediately and will remain in effect until revoked in writing by the Principal.

Signatures:

Principal Signature: ___________________________ Date: ________________

Attorney-in-Fact Signature: ____________________ Date: ________________

Witnesses:

- Witness 1 Signature: _________________________ Date: ________________

- Witness 2 Signature: _________________________ Date: ________________

This document should be reviewed by a legal professional to ensure it meets specific needs and is in accordance with state law.

Listed Questions and Answers

-

What is a Durable Power of Attorney in Tennessee?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual (the principal) to appoint someone else (the agent) to make decisions on their behalf. This authority remains in effect even if the principal becomes incapacitated. In Tennessee, this document can cover financial, medical, or other personal matters.

-

Who can be appointed as an agent?

Any competent adult can be appointed as an agent. This includes family members, friends, or professionals. It is important to choose someone trustworthy, as they will have significant authority over your affairs.

-

What powers can be granted to the agent?

The principal can specify a wide range of powers in the DPOA. These may include managing bank accounts, handling real estate transactions, making healthcare decisions, and more. The principal should clearly outline the scope of authority to avoid any confusion.

-

Does the Durable Power of Attorney need to be notarized?

Yes, in Tennessee, the Durable Power of Attorney must be signed by the principal in the presence of a notary public. This adds a layer of authenticity and helps ensure that the document is legally binding.

-

Can the Durable Power of Attorney be revoked?

Yes, the principal has the right to revoke the DPOA at any time, as long as they are mentally competent. To revoke, the principal should create a written revocation document and notify the agent and any relevant third parties.

-

What happens if the agent cannot serve?

If the appointed agent is unable or unwilling to serve, the DPOA may specify an alternate agent. If no alternate is named, the principal may need to create a new DPOA or appoint a guardian through the court system.

-

Is a Durable Power of Attorney effective immediately?

A DPOA can be designed to take effect immediately or to become effective only upon the principal's incapacity. This choice should be clearly stated in the document to avoid any misunderstandings.

-

Are there any limitations to the powers granted?

Yes, the principal can impose limitations on the powers granted to the agent. For instance, they may restrict the agent from making certain financial decisions or limit their authority to specific transactions. Clear communication of these limitations is essential.

-

What should I do after creating a Durable Power of Attorney?

After creating the DPOA, the principal should provide copies to the agent and any institutions that may need to recognize the document, such as banks or healthcare providers. It is also wise to keep the original document in a safe place.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to appoint someone to make financial or legal decisions on their behalf, even if they become incapacitated. |

| Governing Law | The Durable Power of Attorney in Tennessee is governed by Tennessee Code Annotated § 34-6-101 et seq. |

| Durability | This document remains effective even if the principal becomes incapacitated, which is a key feature of "durable" powers of attorney. |

| Principal | The person who creates the Durable Power of Attorney is known as the principal. |

| Agent | The individual designated to act on behalf of the principal is referred to as the agent or attorney-in-fact. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent to do so. |

| Witnesses | The form must be signed by the principal in the presence of two witnesses who are not related to the principal. |

| Notarization | While notarization is not required, it is recommended to enhance the document's validity and acceptance. |