Attorney-Approved Promissory Note Document for the State of Tennessee

The Tennessee Promissory Note form serves as a crucial financial document that outlines the terms of a loan agreement between a borrower and a lender. This form is designed to provide clarity and security for both parties involved in the transaction. Key components typically included are the principal amount, interest rate, payment schedule, and the maturity date, which specifies when the loan must be repaid in full. Additionally, the form often details the consequences of default, including potential legal actions that may be pursued by the lender. Signatures from both the borrower and lender are required to validate the agreement, ensuring that both parties acknowledge and accept the terms outlined within the document. Understanding the nuances of this form is essential for anyone entering into a lending arrangement in Tennessee, as it establishes the legal framework for the repayment of the borrowed funds.

Consider More Promissory Note Templates for Different States

California Promissory Note Template - Legally enforceable if properly executed and signed by both parties.

The Texas Motorcycle Bill of Sale is a legal document that records the sale of a motorcycle between a buyer and a seller. This form serves as proof of ownership transfer and outlines essential details about the transaction. For more information, you can refer to the Bill Of Sale for a Motorcycle, which provides further insights into its importance and usage to ensure a smooth and lawful exchange of property.

Promissory Note Washington State - Borrowers should understand all terms before signing a promissory note to ensure financial compatibility.

Promissory Note Virginia - Some Promissory Notes will have a specific governing law clause to determine jurisdiction in case of disputes.

Dos and Don'ts

When filling out the Tennessee Promissory Note form, it’s important to follow certain guidelines to ensure the document is valid and enforceable. Here are four things you should and shouldn't do:

- Do: Clearly state the loan amount.

- Do: Include the interest rate, if applicable.

- Don't: Leave any fields blank; all sections must be completed.

- Don't: Use vague language; be specific about repayment terms.

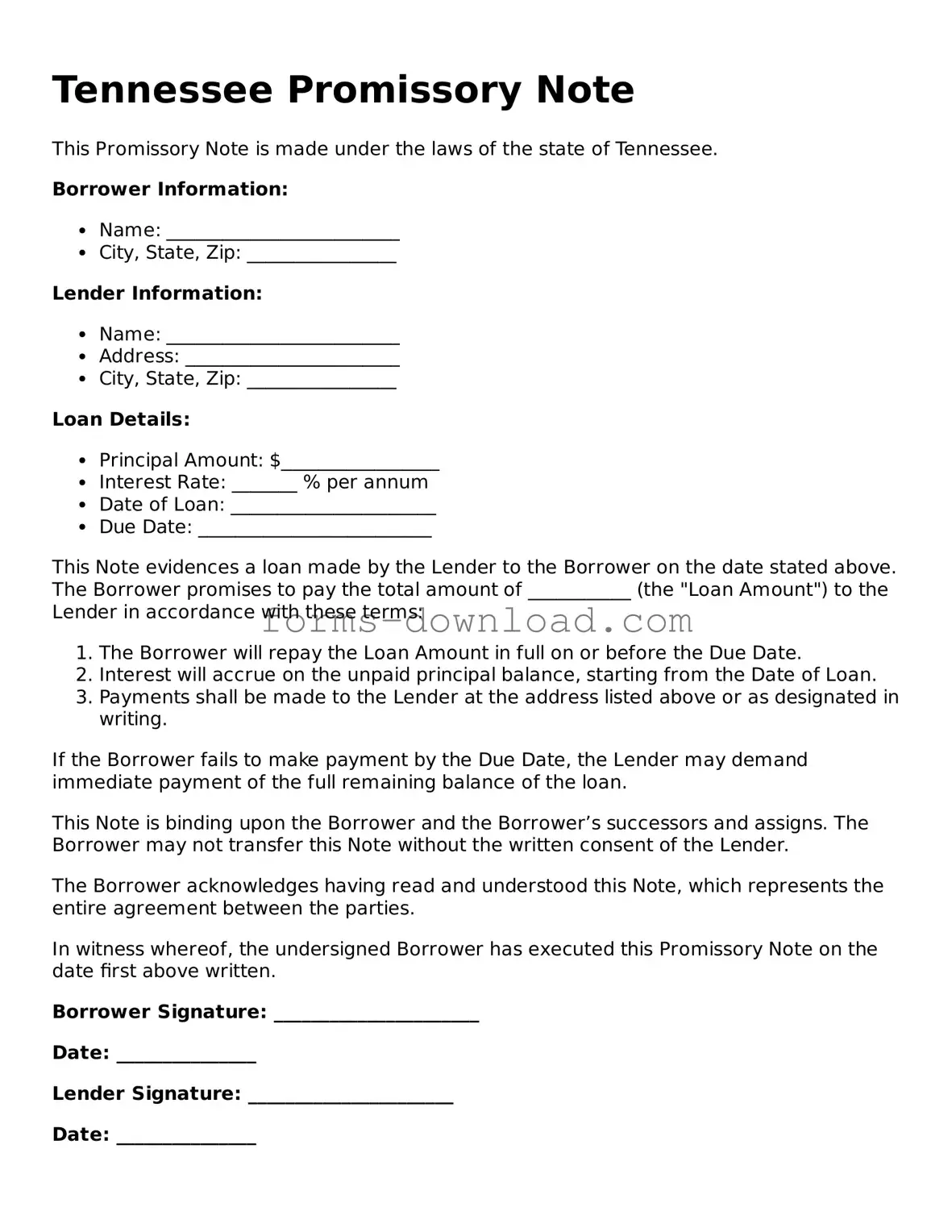

Tennessee Promissory Note Sample

Tennessee Promissory Note

This Promissory Note is made under the laws of the state of Tennessee.

Borrower Information:

- Name: _________________________

- City, State, Zip: ________________

Lender Information:

- Name: _________________________

- Address: _______________________

- City, State, Zip: ________________

Loan Details:

- Principal Amount: $_________________

- Interest Rate: _______ % per annum

- Date of Loan: ______________________

- Due Date: _________________________

This Note evidences a loan made by the Lender to the Borrower on the date stated above. The Borrower promises to pay the total amount of ___________ (the "Loan Amount") to the Lender in accordance with these terms:

- The Borrower will repay the Loan Amount in full on or before the Due Date.

- Interest will accrue on the unpaid principal balance, starting from the Date of Loan.

- Payments shall be made to the Lender at the address listed above or as designated in writing.

If the Borrower fails to make payment by the Due Date, the Lender may demand immediate payment of the full remaining balance of the loan.

This Note is binding upon the Borrower and the Borrower’s successors and assigns. The Borrower may not transfer this Note without the written consent of the Lender.

The Borrower acknowledges having read and understood this Note, which represents the entire agreement between the parties.

In witness whereof, the undersigned Borrower has executed this Promissory Note on the date first above written.

Borrower Signature: ______________________

Date: _______________

Lender Signature: ______________________

Date: _______________

Listed Questions and Answers

-

What is a Tennessee Promissory Note?

A Tennessee Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. It serves as a written record of the loan and includes details such as the principal amount, interest rate, repayment schedule, and any penalties for late payments.

-

Who can use a Promissory Note in Tennessee?

Any individual or business can use a Promissory Note in Tennessee. This includes personal loans between friends or family, as well as business loans between companies. It is important for both parties to understand the terms outlined in the note to avoid potential disputes.

-

What are the key components of a Tennessee Promissory Note?

A typical Promissory Note includes several essential components:

- The names and addresses of the borrower and lender

- The principal amount being borrowed

- The interest rate, if applicable

- The repayment schedule (monthly, quarterly, etc.)

- Any late fees or penalties for missed payments

- Signatures of both parties

-

Is a Promissory Note legally binding in Tennessee?

Yes, a Promissory Note is legally binding in Tennessee as long as it meets certain requirements. Both parties must agree to the terms, and the document must be signed. It is advisable to have the note notarized for added legal protection, although it is not strictly necessary.

-

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan as outlined in the Promissory Note, the lender has several options. They may attempt to collect the debt through negotiation or mediation. If those efforts fail, the lender can take legal action to recover the owed amount. This may involve filing a lawsuit against the borrower.

-

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the amended note to ensure clarity and legal validity.

-

Where can I find a Tennessee Promissory Note template?

Templates for Tennessee Promissory Notes can be found online through various legal websites, or you may consult an attorney for a customized document. Ensure that any template you use complies with Tennessee laws and meets your specific needs.

PDF Characteristics

| Fact Name | Details |

|---|---|

| Definition | A Tennessee Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The governing law for Promissory Notes in Tennessee is found in the Tennessee Uniform Commercial Code (UCC), specifically Title 47, Chapter 3. |

| Parties Involved | The note involves two main parties: the borrower (maker) who promises to pay and the lender (payee) who receives the payment. |

| Interest Rate | The interest rate can be fixed or variable, and it must be clearly stated in the note. |

| Payment Terms | Payment terms should outline when payments are due, including any grace periods or late fees. |

| Signatures | The note must be signed by the borrower to be legally binding, and it is advisable for the lender to sign as well. |

| Enforceability | A properly executed Promissory Note is enforceable in a court of law, provided it meets all legal requirements. |