Attorney-Approved Real Estate Purchase Agreement Document for the State of Tennessee

The Tennessee Real Estate Purchase Agreement form serves as a crucial document in the home buying and selling process within the state. This form outlines the terms and conditions agreed upon by the buyer and seller, ensuring that both parties have a clear understanding of their rights and responsibilities. Key components of the agreement include the purchase price, the closing date, and any contingencies that must be met before the sale can be finalized. Additionally, it addresses important details such as the property description, earnest money deposit, and any included fixtures or appliances. By specifying these elements, the agreement helps to minimize misunderstandings and provides a framework for resolving disputes should they arise. Understanding this form is essential for anyone involved in a real estate transaction in Tennessee, as it lays the groundwork for a successful transfer of property ownership.

Consider More Real Estate Purchase Agreement Templates for Different States

Florida Purchase Agreement - Signatures from both parties are required to validate the agreement.

For those interested in accessing important documents, the essential aspects of the Hold Harmless Agreement can be found through our guide at important Hold Harmless Agreement template resource, which provides valuable insights for both parties involved.

Virginia Real Estate Contract - The form may require the seller to provide a warranty or guarantee regarding the property’s title.

Dos and Don'ts

When filling out the Tennessee Real Estate Purchase Agreement form, attention to detail is crucial. Here’s a helpful list of things to do and avoid to ensure a smooth process.

- Do read the entire agreement thoroughly before filling it out.

- Do clearly state the names of all parties involved in the transaction.

- Do include accurate property details, such as the address and legal description.

- Do specify the purchase price and any earnest money deposits.

- Do review deadlines for inspections, financing, and closing dates carefully.

- Don't leave any sections blank; if a section doesn’t apply, write "N/A."

- Don't use vague language; be specific about terms and conditions.

- Don't forget to include any contingencies that may affect the sale.

- Don't rush through the process; take your time to ensure accuracy.

- Don't overlook the importance of signatures; ensure all parties sign the agreement.

By following these guidelines, you can help ensure that your Tennessee Real Estate Purchase Agreement is filled out correctly and comprehensively.

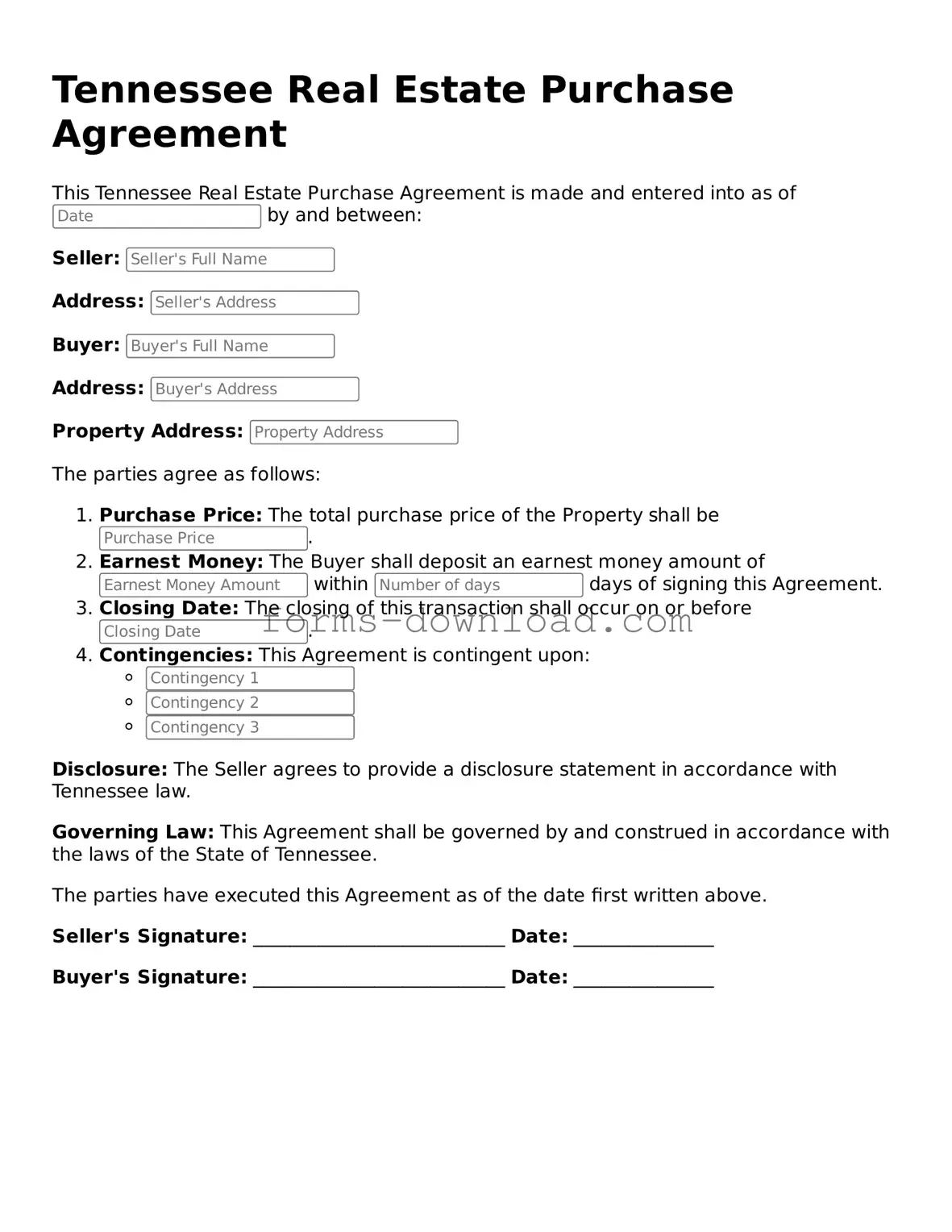

Tennessee Real Estate Purchase Agreement Sample

Tennessee Real Estate Purchase Agreement

This Tennessee Real Estate Purchase Agreement is made and entered into as of by and between:

Seller:

Address:

Buyer:

Address:

Property Address:

The parties agree as follows:

- Purchase Price: The total purchase price of the Property shall be .

- Earnest Money: The Buyer shall deposit an earnest money amount of within days of signing this Agreement.

- Closing Date: The closing of this transaction shall occur on or before .

- Contingencies: This Agreement is contingent upon:

Disclosure: The Seller agrees to provide a disclosure statement in accordance with Tennessee law.

Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Tennessee.

The parties have executed this Agreement as of the date first written above.

Seller's Signature: ___________________________ Date: _______________

Buyer's Signature: ___________________________ Date: _______________

Listed Questions and Answers

-

What is the Tennessee Real Estate Purchase Agreement?

The Tennessee Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a property will be bought and sold in Tennessee. It serves as a formal agreement between the buyer and the seller, detailing important aspects such as the purchase price, closing date, and any contingencies that may apply.

-

What are the key components of this agreement?

The agreement typically includes several key components:

- Parties Involved: Names and contact information of both the buyer and the seller.

- Property Description: A detailed description of the property being sold, including its address and any relevant legal descriptions.

- Purchase Price: The agreed-upon price for the property.

- Earnest Money: An amount paid by the buyer to demonstrate serious intent to purchase, which is held in escrow.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing or inspections.

- Closing Details: Information about when and where the closing will take place.

-

Are there any contingencies I should consider including?

Contingencies are crucial as they protect the interests of both parties. Common contingencies include:

- Financing Contingency: Allows the buyer to back out if they cannot secure a mortgage.

- Inspection Contingency: Permits the buyer to conduct a home inspection and negotiate repairs or price adjustments based on findings.

- Appraisal Contingency: Ensures the property appraises at or above the purchase price, protecting the buyer from overpaying.

-

How is earnest money handled in the agreement?

Earnest money is typically a percentage of the purchase price and is submitted with the agreement to show the buyer's commitment. This money is held in an escrow account until closing. If the sale goes through, it is applied to the purchase price. If the buyer backs out without a valid reason outlined in the contingencies, the seller may keep the earnest money as compensation for the time the property was off the market.

-

What happens if one party wants to back out of the agreement?

If either party wishes to back out, they must refer to the contingencies outlined in the agreement. If the contingencies are met, the buyer can withdraw without penalty. However, if the buyer decides to back out for reasons not covered by contingencies, they may forfeit their earnest money. Sellers may also face consequences if they back out without valid reasons, such as legal action or losing the earnest money.

-

Can the agreement be modified after it is signed?

Yes, the Tennessee Real Estate Purchase Agreement can be modified after it is signed, but any changes must be agreed upon by both parties. It is essential to document any amendments in writing and have both parties sign the modifications. This ensures that all parties are aware of and agree to the new terms.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Tennessee Real Estate Purchase Agreement is governed by the laws of the State of Tennessee. |

| Purpose | This form serves as a legally binding contract between a buyer and a seller for the purchase of real estate in Tennessee. |

| Key Components | The agreement typically includes details such as purchase price, property description, and closing date. |

| Disclosure Requirements | Sellers are required to disclose known defects and issues with the property, ensuring transparency in the transaction. |