Attorney-Approved Transfer-on-Death Deed Document for the State of Tennessee

The Tennessee Transfer-on-Death Deed is a significant legal tool that allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This deed provides a straightforward way to ensure that your property passes directly to your heirs, which can simplify the transfer process and reduce the associated costs and delays. By filling out this form, property owners can retain full control of their property during their lifetime, as the transfer only takes effect after their passing. Importantly, the deed must be properly executed and recorded to be valid, ensuring that the beneficiaries' rights are protected. Understanding the requirements and implications of this deed is crucial for anyone considering estate planning in Tennessee, as it can provide peace of mind and clarity regarding the future of one’s property. In addition, it is essential to note that the Transfer-on-Death Deed does not affect the property owner's ability to sell or mortgage the property during their lifetime, offering flexibility and security in managing one’s assets.

Consider More Transfer-on-Death Deed Templates for Different States

Transfer on Death Deed Washington State Form - Utilizing this form is a reasonable step towards comprehensive estate planning for real property ownership.

Transfer on Death Deed Form Florida - A Transfer-on-Death Deed is not a substitute for a will but can complement an overall estate plan.

When engaging in the sale of a vessel, it is essential for both the buyer and the seller to complete the required documentation accurately, and the Bill of Sale for a Boat in California stands out as a key form that ensures the legal transfer of ownership is well-documented and recognized by state authorities.

What Are the Disadvantages of a Transfer on Death Deed? - It’s essential to check your state’s laws, as Transfer-on-Death Deeds may not be available everywhere.

Lady Bird Deed Virginia - Offers a straightforward method to convey real estate without significant legal hurdles.

Dos and Don'ts

When filling out the Tennessee Transfer-on-Death Deed form, it is essential to be careful and thorough. This deed allows property owners to transfer their property to beneficiaries upon their death without going through probate. Here are some important do's and don'ts to keep in mind:

- Do ensure that you are the sole owner of the property or have the authority to transfer it.

- Do clearly identify the property by including the correct legal description.

- Do list the beneficiaries' full names and their relationship to you.

- Do sign the deed in the presence of a notary public.

- Don't use vague language or abbreviations that could cause confusion.

- Don't forget to record the deed with the appropriate county office after signing.

- Don't neglect to keep a copy of the recorded deed for your records.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is completed correctly and serves its intended purpose.

Tennessee Transfer-on-Death Deed Sample

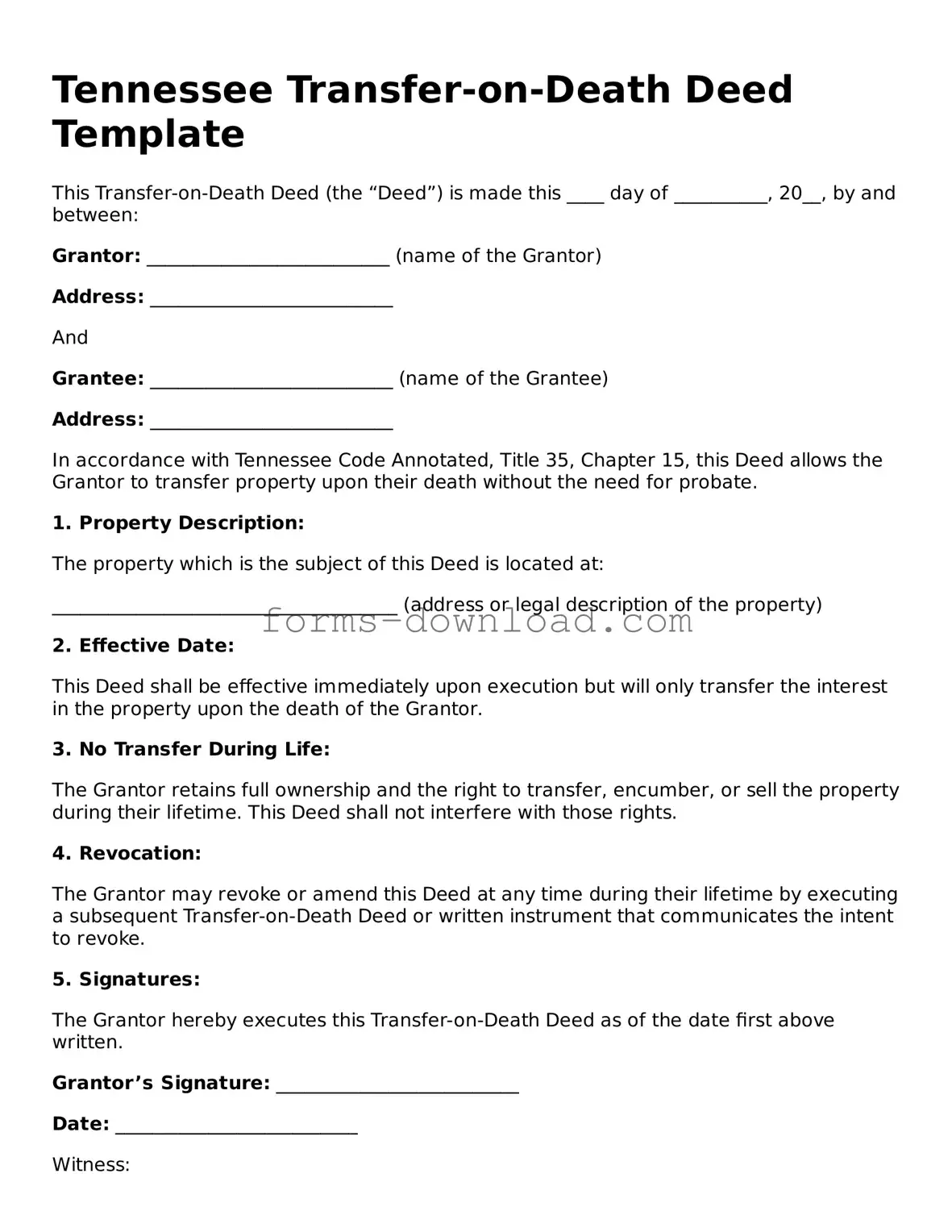

Tennessee Transfer-on-Death Deed Template

This Transfer-on-Death Deed (the “Deed”) is made this ____ day of __________, 20__, by and between:

Grantor: __________________________ (name of the Grantor)

Address: __________________________

And

Grantee: __________________________ (name of the Grantee)

Address: __________________________

In accordance with Tennessee Code Annotated, Title 35, Chapter 15, this Deed allows the Grantor to transfer property upon their death without the need for probate.

1. Property Description:

The property which is the subject of this Deed is located at:

_____________________________________ (address or legal description of the property)

2. Effective Date:

This Deed shall be effective immediately upon execution but will only transfer the interest in the property upon the death of the Grantor.

3. No Transfer During Life:

The Grantor retains full ownership and the right to transfer, encumber, or sell the property during their lifetime. This Deed shall not interfere with those rights.

4. Revocation:

The Grantor may revoke or amend this Deed at any time during their lifetime by executing a subsequent Transfer-on-Death Deed or written instrument that communicates the intent to revoke.

5. Signatures:

The Grantor hereby executes this Transfer-on-Death Deed as of the date first above written.

Grantor’s Signature: __________________________

Date: __________________________

Witness:

Name: __________________________

Signature: __________________________

Date: __________________________

Notary Public:

State of Tennessee

County of __________________________

Subscribed and sworn to before me on this ____ day of __________, 20__.

Notary Public Signature: __________________________

My commission expires: __________________________

Listed Questions and Answers

-

What is a Tennessee Transfer-on-Death Deed?

A Tennessee Transfer-on-Death Deed (TOD deed) is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death. This deed enables property owners to maintain control of their property during their lifetime while simplifying the transfer process after they pass away.

-

How does a Transfer-on-Death Deed work?

When a property owner executes a TOD deed, they name one or more beneficiaries who will receive the property automatically upon their death. The property does not go through probate, which can save time and money. The owner retains full control of the property during their lifetime, meaning they can sell, mortgage, or change the beneficiaries at any time.

-

Are there any requirements for creating a TOD deed in Tennessee?

Yes, there are specific requirements. The deed must be in writing, signed by the property owner, and notarized. Additionally, it must be recorded in the county where the property is located to be effective. It’s essential to ensure that all legal requirements are met to avoid complications later.

-

Can I revoke or change a Transfer-on-Death Deed?

Absolutely! A property owner can revoke or change a TOD deed at any time before their death. This can be done by creating a new deed that explicitly revokes the previous one or by executing a revocation form. It’s crucial to record any changes with the county to ensure they are legally recognized.

-

What happens if a beneficiary predeceases the property owner?

If a beneficiary named in the TOD deed passes away before the property owner, the transfer to that beneficiary will not occur. Instead, the property will typically pass to the remaining beneficiaries. If no beneficiaries survive the owner, the property may go to the owner’s estate and be distributed according to the owner’s will or state intestacy laws.

PDF Characteristics

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Tennessee to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Tennessee Transfer-on-Death Deed is governed by Tennessee Code Annotated § 66-4-201 through § 66-4-205. |

| Eligibility | Any individual who holds title to real property in Tennessee can execute a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can name one or more beneficiaries in the deed, who will receive the property after the owner's death. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner through a written document. |

| Filing Requirements | The deed must be recorded with the county register of deeds in the county where the property is located to be effective. |

| Tax Implications | There are no immediate tax implications for transferring property via a Transfer-on-Death Deed; taxes may apply upon the beneficiary's receipt of the property. |

| Limitations | The Transfer-on-Death Deed cannot be used for all types of property, such as property held in joint tenancy or community property. |

| Legal Assistance | While individuals can create this deed without legal help, consulting an attorney is recommended to ensure compliance with state laws. |