Fillable Transfer-on-Death Deed Form

The Transfer-on-Death Deed (TODD) is a powerful estate planning tool that allows property owners to designate beneficiaries who will receive their real estate upon their death, bypassing the often lengthy probate process. This deed enables individuals to retain full control over their property during their lifetime, as it does not take effect until they pass away. Importantly, the TODD can be revoked or altered at any time before the owner's death, providing flexibility to adapt to changing circumstances. Beneficiaries named in the deed have no rights to the property while the owner is alive, ensuring that the owner's wishes remain paramount. Additionally, the TODD can simplify the transfer of property, making it a valuable option for those looking to streamline their estate planning. Understanding the nuances of this form is essential for anyone considering its use, as it can have significant implications for how property is managed and passed on after death.

Transfer-on-Death DeedTemplates for Particular US States

More Transfer-on-Death Deed Forms:

Deed-in-lieu of Foreclosure - The goal of a Deed in Lieu is to reach a mutual agreement beneficial for both the lender and the homeowner.

The Massachusetts Boat Bill of Sale form is a crucial document used to transfer ownership of a boat from one party to another. This form provides essential details about the transaction, including the buyer and seller's information, the boat's description, and the sale price. For more information on how to complete the process correctly, you can visit the Bill of Sale for a Boat webpage, which offers further guidance and resources to ensure a smooth transfer.

Correction Deed Form California - It serves to accurately document changes in property ownership details.

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it's essential to follow specific guidelines to ensure the process goes smoothly. Here are six important dos and don'ts:

- Do provide accurate property information, including the legal description.

- Do include the names of all beneficiaries clearly.

- Do sign the deed in front of a notary public.

- Do check your state’s specific requirements for the deed.

- Don't leave out any required signatures or dates.

- Don't forget to file the deed with the appropriate county office.

Transfer-on-Death Deed Sample

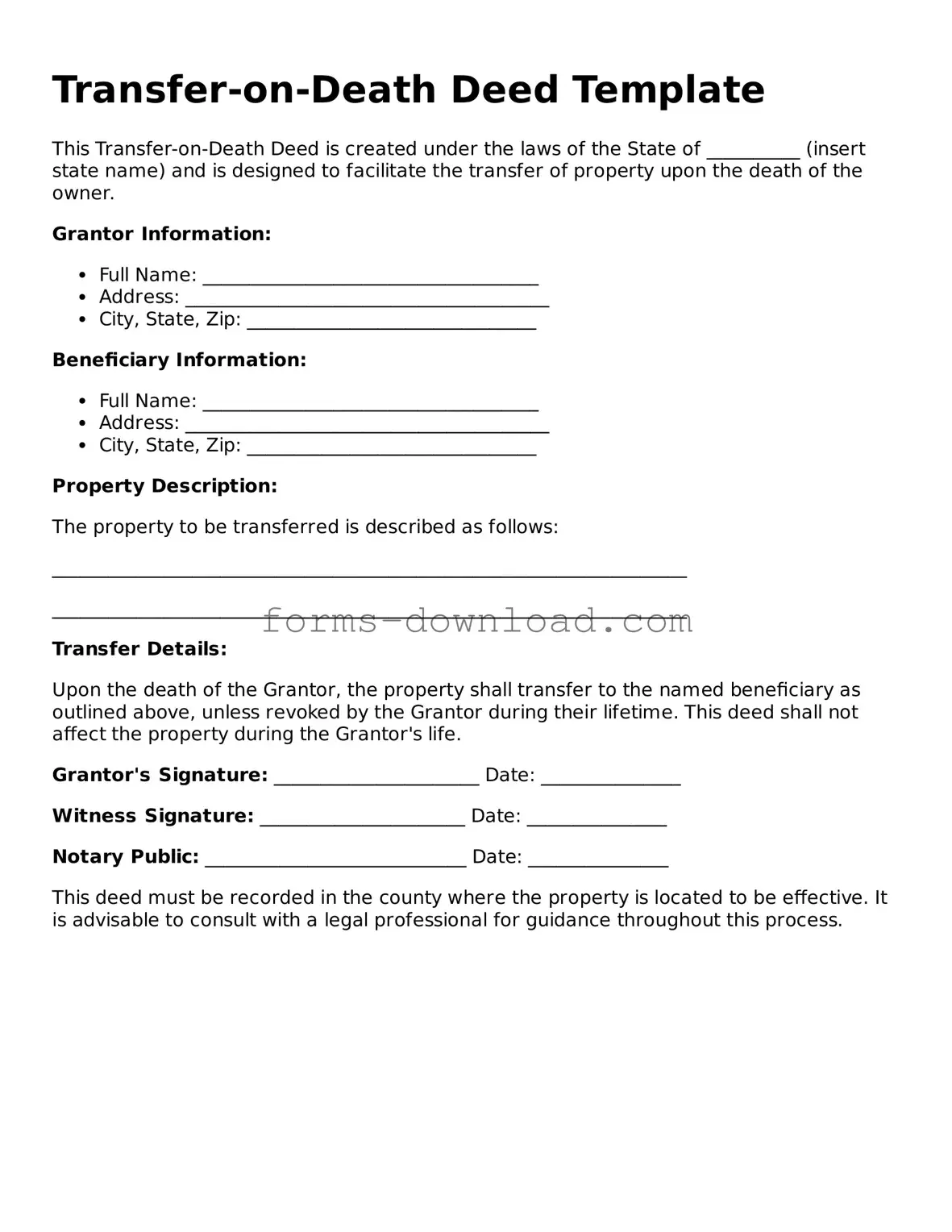

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created under the laws of the State of __________ (insert state name) and is designed to facilitate the transfer of property upon the death of the owner.

Grantor Information:

- Full Name: ____________________________________

- Address: _______________________________________

- City, State, Zip: _______________________________

Beneficiary Information:

- Full Name: ____________________________________

- Address: _______________________________________

- City, State, Zip: _______________________________

Property Description:

The property to be transferred is described as follows:

____________________________________________________________________

____________________________________________________________________

Transfer Details:

Upon the death of the Grantor, the property shall transfer to the named beneficiary as outlined above, unless revoked by the Grantor during their lifetime. This deed shall not affect the property during the Grantor's life.

Grantor's Signature: ______________________ Date: _______________

Witness Signature: ______________________ Date: _______________

Notary Public: ____________________________ Date: _______________

This deed must be recorded in the county where the property is located to be effective. It is advisable to consult with a legal professional for guidance throughout this process.

Listed Questions and Answers

-

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TODD) is a legal document that allows an individual to transfer real estate property to a designated beneficiary upon the individual's death. This deed enables the property owner to retain full control over the property during their lifetime, while ensuring that the transfer occurs automatically without the need for probate.

-

How does a Transfer-on-Death Deed work?

The property owner completes the TODD by naming one or more beneficiaries and signing the deed in accordance with state laws. Once the deed is properly recorded with the county recorder's office, it becomes effective. Upon the owner's death, the property automatically transfers to the named beneficiaries without going through the probate process, simplifying the transfer and often reducing costs.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be changed or revoked at any time during the property owner's lifetime. To do this, the owner must create a new deed that either updates the beneficiaries or explicitly revokes the previous deed. It is crucial to record the new deed with the appropriate county office to ensure that the changes are legally recognized.

-

Are there any limitations to using a Transfer-on-Death Deed?

While a TODD is a useful estate planning tool, there are some limitations to consider. For instance, it cannot be used for all types of property, such as certain types of jointly owned property or property subject to a mortgage that may have specific terms. Additionally, beneficiaries must be individuals or entities that can legally hold title. It is advisable to consult with a legal professional to understand these limitations fully.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon their death without going through probate. |

| Governing Law | The use of Transfer-on-Death Deeds is governed by state law, with specific statutes varying by state. For example, California's law is found in Probate Code Section 5600. |

| Beneficiary Designation | The deed must clearly name the beneficiary who will receive the property upon the owner’s death. |

| Revocability | Owners can revoke or change the Transfer-on-Death Deed at any time during their lifetime, as long as they follow the proper legal procedures. |

| No Immediate Transfer | The transfer of property does not occur until the death of the property owner; until then, the owner retains full control of the property. |

| Tax Implications | Property transferred via a Transfer-on-Death Deed may still be subject to estate taxes, depending on the overall value of the estate. |

| State-Specific Forms | Each state may have its own specific form for a Transfer-on-Death Deed. It is essential to use the correct form to ensure validity. |

| Effect on Creditors | Creditors may still have claims against the property until debts are settled, even after the Transfer-on-Death Deed is executed. |

| Limitations | Transfer-on-Death Deeds typically cannot be used for all types of property, such as certain types of jointly owned property or property held in a trust. |