Fillable Vehicle Repayment Agreement Form

The Vehicle Repayment Agreement form serves as a crucial document in the realm of auto financing, outlining the terms and conditions under which a borrower agrees to repay a loan for a vehicle. This agreement typically details the total amount financed, the interest rate, and the repayment schedule, ensuring that both parties understand their obligations. It may also include provisions regarding late payments, default consequences, and the rights of the lender in the event of non-compliance. By clearly delineating these aspects, the form protects the interests of both the borrower and the lender, fostering transparency and accountability. Additionally, it often requires the borrower’s acknowledgment of various disclosures, such as the total cost of the loan and the implications of defaulting. Understanding the intricacies of this form is essential for anyone involved in vehicle financing, as it lays the groundwork for a successful financial relationship and helps prevent misunderstandings that could lead to disputes down the line.

Popular Forms:

Run a Background Check on Myself - Make sure all letters and numbers are legible to avoid confusion.

In Texas, the importance of proper documentation during a boat sale cannot be overstated, and one key resource for this is the Bill of Sale for a Boat, which allows both parties to clearly outline the terms of the transaction and ensure a legally binding agreement is established.

Sample Letter of Intent for Grant Funding Pdf - Identifies target demographics or populations affected by the project.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it's crucial to be thorough and accurate. Here are important do's and don'ts to consider:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do double-check all numbers and figures for accuracy.

- Do sign and date the form where required.

- Don't leave any sections blank unless instructed to do so.

- Don't use correction fluid to alter any information.

- Don't submit the form without reviewing it for errors.

- Don't ignore deadlines for submission.

Following these guidelines will help ensure that your form is processed smoothly and efficiently.

Vehicle Repayment Agreement Sample

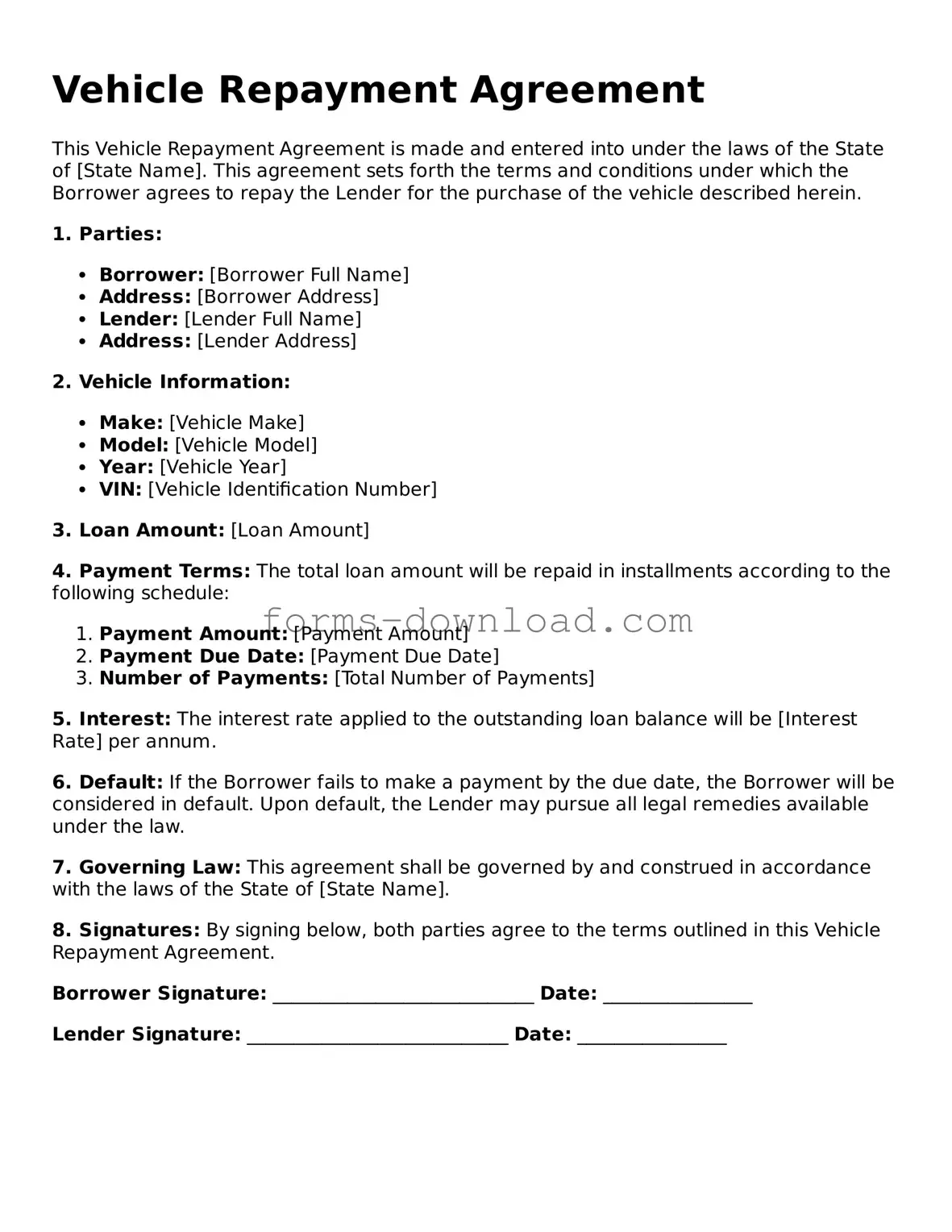

Vehicle Repayment Agreement

This Vehicle Repayment Agreement is made and entered into under the laws of the State of [State Name]. This agreement sets forth the terms and conditions under which the Borrower agrees to repay the Lender for the purchase of the vehicle described herein.

1. Parties:

- Borrower: [Borrower Full Name]

- Address: [Borrower Address]

- Lender: [Lender Full Name]

- Address: [Lender Address]

2. Vehicle Information:

- Make: [Vehicle Make]

- Model: [Vehicle Model]

- Year: [Vehicle Year]

- VIN: [Vehicle Identification Number]

3. Loan Amount: [Loan Amount]

4. Payment Terms: The total loan amount will be repaid in installments according to the following schedule:

- Payment Amount: [Payment Amount]

- Payment Due Date: [Payment Due Date]

- Number of Payments: [Total Number of Payments]

5. Interest: The interest rate applied to the outstanding loan balance will be [Interest Rate] per annum.

6. Default: If the Borrower fails to make a payment by the due date, the Borrower will be considered in default. Upon default, the Lender may pursue all legal remedies available under the law.

7. Governing Law: This agreement shall be governed by and construed in accordance with the laws of the State of [State Name].

8. Signatures: By signing below, both parties agree to the terms outlined in this Vehicle Repayment Agreement.

Borrower Signature: ____________________________ Date: ________________

Lender Signature: ____________________________ Date: ________________

Listed Questions and Answers

-

What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a legal document that outlines the terms and conditions under which an individual agrees to repay a loan or debt related to a vehicle. This agreement is typically used when a borrower has fallen behind on payments and wants to establish a new repayment plan with the lender.

-

Who needs to fill out this form?

Anyone who has taken out a loan to purchase a vehicle and is experiencing difficulty in making payments may need to fill out this form. It is particularly useful for individuals looking to negotiate a new payment schedule or to formalize an arrangement with their lender.

-

What information is required on the form?

The form typically requires personal information, such as the borrower’s name, contact details, and vehicle information, including the make, model, and VIN (Vehicle Identification Number). Additionally, it will include details about the original loan, the amount owed, and the proposed repayment plan.

-

How does the repayment plan work?

The repayment plan outlined in the agreement specifies how much the borrower will pay, the frequency of payments, and the duration of the repayment period. It may also include information about any interest rates or fees associated with the loan. Both parties must agree to the terms before signing the document.

-

What happens if I miss a payment?

Missing a payment can lead to serious consequences, including additional fees, penalties, or even repossession of the vehicle. It is crucial to communicate with the lender as soon as possible if you anticipate missing a payment. Many lenders may be willing to work with you to adjust the repayment plan.

-

Can I modify the agreement after it is signed?

Yes, modifications can be made to the Vehicle Repayment Agreement, but both parties must agree to any changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement to ensure clarity and enforceability.

-

Where can I obtain a Vehicle Repayment Agreement form?

You can typically obtain a Vehicle Repayment Agreement form from your lender or financial institution. Additionally, many legal websites and resources offer templates that can be customized to fit your specific situation. Always ensure that the form you use complies with your state’s laws.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is used to outline the terms for repaying a loan or debt related to a vehicle. |

| Parties Involved | This agreement typically involves a borrower (the person taking the loan) and a lender (the financial institution or individual providing the loan). |

| Governing Law | The agreement is subject to the laws of the state where the borrower resides. For example, in California, it follows the California Civil Code. |

| Loan Amount | The form specifies the total amount of money borrowed for the vehicle purchase. |

| Interest Rate | The agreement outlines the interest rate applied to the loan, which can be fixed or variable. |

| Payment Schedule | A clear payment schedule is provided, detailing how often payments are due and the amount of each payment. |

| Late Fees | The form may include information about late fees if payments are not made on time. |

| Default Terms | It outlines what constitutes a default on the loan and the consequences of defaulting. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties. |