Attorney-Approved Gift Deed Document for the State of Virginia

The Virginia Gift Deed form serves as an essential legal document for individuals wishing to transfer property without the exchange of money. This form is particularly significant for those looking to gift real estate to family members or friends, ensuring that the transaction is documented appropriately and complies with state regulations. By outlining the details of the property, the parties involved, and the intent to make a gift, the form provides clarity and protection for both the giver and the recipient. It is crucial to understand the implications of using a gift deed, as it can affect tax liabilities and ownership rights. Additionally, the Virginia Gift Deed form must be executed with the proper signatures and notarization to be legally binding, making it important for individuals to follow the correct procedures. Familiarity with this form can help ease the process of transferring property and ensure that the gift is recognized by the state, allowing both parties to move forward with confidence.

Consider More Gift Deed Templates for Different States

How to Add Someone to House Title in California - The use of a Gift Deed can foster relationships by promoting generosity and giving.

When selling a boat in California, it is essential to utilize the appropriate documentation to ensure a seamless transaction. The California Boat Bill of Sale form acts as proof of ownership transfer and includes vital details about both the buyer and seller. For those new to this process, it is advisable to familiarize yourself with the requirements of the form, which can be found here: Bill of Sale for a Boat.

Dos and Don'ts

When filling out the Virginia Gift Deed form, it's important to follow certain guidelines to ensure the process goes smoothly. Here is a list of things to do and not to do:

- Do: Provide accurate information about the property being gifted.

- Do: Include the names and addresses of both the giver and the recipient.

- Do: Sign the form in front of a notary public.

- Do: Check for any local requirements that may apply to the deed.

- Don't: Leave any sections of the form blank.

- Don't: Use unclear or vague descriptions of the property.

- Don't: Forget to date the form when signing.

- Don't: Submit the form without making copies for your records.

Virginia Gift Deed Sample

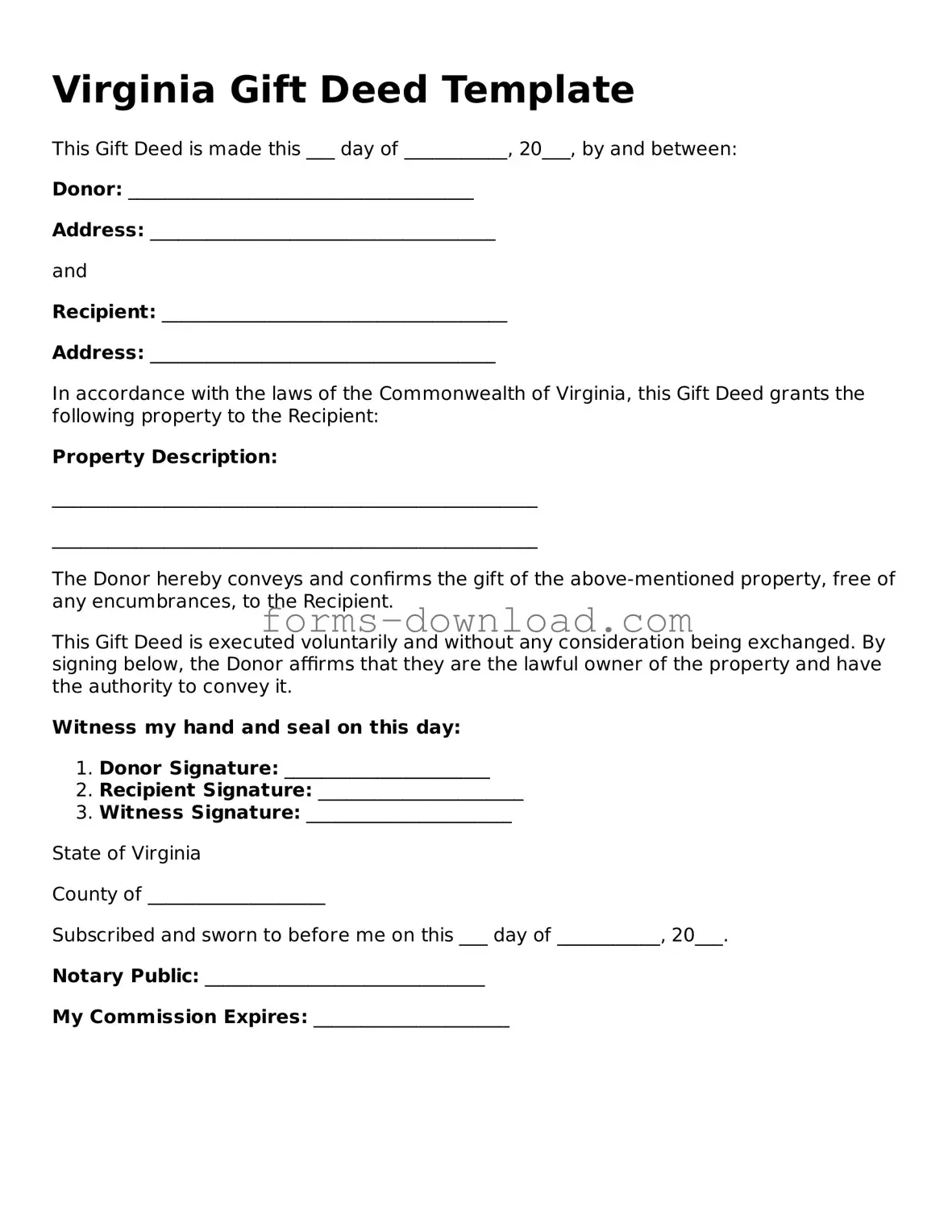

Virginia Gift Deed Template

This Gift Deed is made this ___ day of ___________, 20___, by and between:

Donor: _____________________________________

Address: _____________________________________

and

Recipient: _____________________________________

Address: _____________________________________

In accordance with the laws of the Commonwealth of Virginia, this Gift Deed grants the following property to the Recipient:

Property Description:

____________________________________________________

____________________________________________________

The Donor hereby conveys and confirms the gift of the above-mentioned property, free of any encumbrances, to the Recipient.

This Gift Deed is executed voluntarily and without any consideration being exchanged. By signing below, the Donor affirms that they are the lawful owner of the property and have the authority to convey it.

Witness my hand and seal on this day:

- Donor Signature: ______________________

- Recipient Signature: ______________________

- Witness Signature: ______________________

State of Virginia

County of ___________________

Subscribed and sworn to before me on this ___ day of ___________, 20___.

Notary Public: ______________________________

My Commission Expires: _____________________

Listed Questions and Answers

-

What is a Virginia Gift Deed?

A Virginia Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. It is often used when a property owner wishes to give their property as a gift to a family member or friend.

-

What properties can be transferred using a Gift Deed?

In Virginia, a Gift Deed can be used to transfer various types of property, including real estate, personal property, and sometimes even intangible assets. However, it is most commonly associated with real estate transactions.

-

Are there any tax implications when using a Gift Deed?

Yes, there can be tax implications. While the recipient of the gift generally does not have to pay income tax on the gift, the giver may need to consider federal gift tax rules. If the value of the gift exceeds a certain annual exclusion limit, the giver might need to file a gift tax return. It’s advisable to consult with a tax professional to understand the specific implications.

-

Do I need to have the Gift Deed notarized?

Yes, in Virginia, a Gift Deed must be notarized to be legally valid. This means that the person giving the gift must sign the document in the presence of a notary public, who will then affix their seal to the document.

-

Can I revoke a Gift Deed after it has been signed?

Generally, once a Gift Deed is executed and delivered, it cannot be revoked. However, if certain conditions exist, such as fraud or undue influence, it may be possible to challenge the deed in court. It’s important to seek legal advice if you believe revocation may be necessary.

-

How do I prepare a Gift Deed?

Preparing a Gift Deed involves several steps. First, you will need to clearly identify the property being gifted and the parties involved. Then, you can draft the deed, ensuring it includes all necessary information. It’s often beneficial to use a template or consult with a legal professional to ensure compliance with Virginia laws.

-

Is there a specific format for a Gift Deed in Virginia?

While there is no official state form for a Gift Deed, it must include certain elements, such as the names of the grantor (the person giving the gift) and the grantee (the person receiving the gift), a legal description of the property, and the statement of the gift. The deed should also be signed and notarized.

-

What happens after the Gift Deed is executed?

After the Gift Deed is executed, it should be recorded with the local county clerk’s office where the property is located. Recording the deed provides public notice of the transfer and protects the grantee’s ownership rights.

-

Can a Gift Deed be used to transfer property to a trust?

Yes, a Gift Deed can be used to transfer property into a trust. This can be an effective way to manage and protect the property for future beneficiaries. However, it’s advisable to consult with a legal expert to ensure that the transfer aligns with your estate planning goals.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Virginia Gift Deed is a legal document used to transfer property as a gift without any exchange of money. |

| Governing Law | The Virginia Gift Deed is governed by Virginia Code § 55.1-600 et seq. |

| Parties Involved | The deed involves a donor (the person giving the gift) and a donee (the person receiving the gift). |

| Consideration | No monetary consideration is required for a gift deed to be valid. |

| Signature Requirement | The donor must sign the deed for it to be legally binding. |

| Witnesses | In Virginia, the deed must be witnessed by at least one person. |

| Notarization | While notarization is not required, it is recommended for added legal protection. |

| Recording | To provide public notice, the deed should be recorded in the local county clerk's office. |

| Tax Implications | Gift deeds may have tax implications for both the donor and the donee, depending on the value of the property. |

| Revocation | A gift deed can be revoked by the donor before it is delivered to the donee. |