Attorney-Approved Promissory Note Document for the State of Virginia

The Virginia Promissory Note form serves as a crucial document in financial transactions, outlining the terms under which one party agrees to repay a specific sum of money to another party. This form typically includes essential elements such as the names of the borrower and lender, the principal amount borrowed, the interest rate, and the repayment schedule. Additionally, it may specify the consequences of default, including late fees or legal action. The document can be tailored to include terms that reflect the unique agreement between the parties involved, such as whether the note is secured or unsecured. Understanding the structure and components of the Virginia Promissory Note is vital for both lenders and borrowers, as it clarifies expectations and responsibilities, thereby minimizing potential disputes in the future.

Consider More Promissory Note Templates for Different States

California Promissory Note Template - Facilitates financial planning by outlining expected repayment timelines.

This Homeschool Letter of Intent is a crucial document for parents looking to ensure a smooth transition to home education, providing a solid foundation for their children's learning journey. For more assistance, check out the guide on creating your own helpful Homeschool Letter of Intent template.

Tennessee Promissory Note - It outlines the terms of repayment between a borrower and a lender.

Dos and Don'ts

When filling out the Virginia Promissory Note form, it is essential to approach the task with care. Below is a list of things you should and shouldn't do to ensure accuracy and clarity.

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information, including names, addresses, and amounts.

- Do clearly state the repayment terms, including interest rates and payment schedules.

- Do sign and date the document in the appropriate sections.

- Do keep a copy of the completed Promissory Note for your records.

- Don't leave any blank spaces; if a section does not apply, indicate that clearly.

- Don't use unclear language or abbreviations that may confuse the terms of the agreement.

Following these guidelines will help ensure that the Promissory Note is completed correctly and serves its intended purpose effectively.

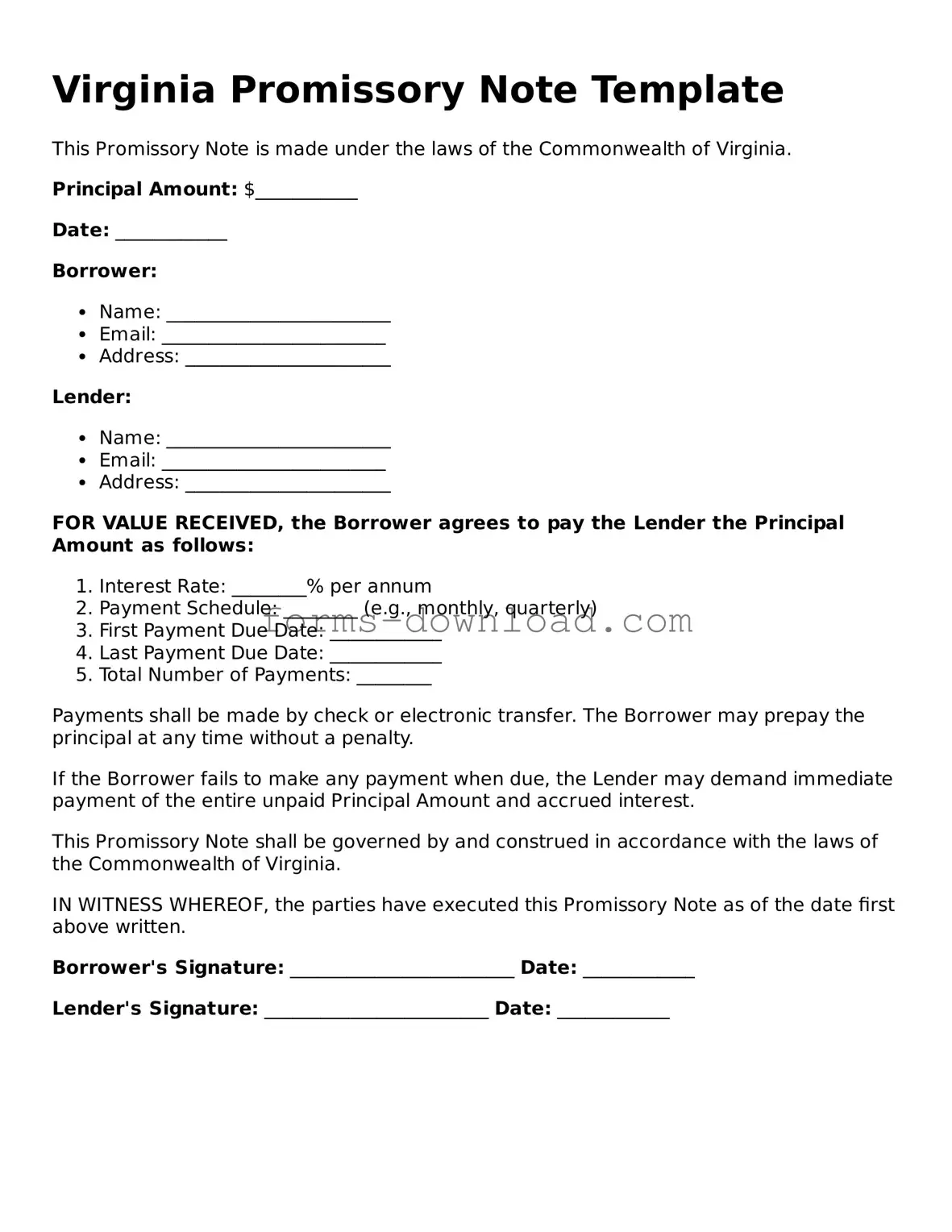

Virginia Promissory Note Sample

Virginia Promissory Note Template

This Promissory Note is made under the laws of the Commonwealth of Virginia.

Principal Amount: $___________

Date: ____________

Borrower:

- Name: ________________________

- Email: ________________________

- Address: ______________________

Lender:

- Name: ________________________

- Email: ________________________

- Address: ______________________

FOR VALUE RECEIVED, the Borrower agrees to pay the Lender the Principal Amount as follows:

- Interest Rate: ________% per annum

- Payment Schedule: ________ (e.g., monthly, quarterly)

- First Payment Due Date: ____________

- Last Payment Due Date: ____________

- Total Number of Payments: ________

Payments shall be made by check or electronic transfer. The Borrower may prepay the principal at any time without a penalty.

If the Borrower fails to make any payment when due, the Lender may demand immediate payment of the entire unpaid Principal Amount and accrued interest.

This Promissory Note shall be governed by and construed in accordance with the laws of the Commonwealth of Virginia.

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the date first above written.

Borrower's Signature: ________________________ Date: ____________

Lender's Signature: ________________________ Date: ____________

Listed Questions and Answers

-

What is a Virginia Promissory Note?

A Virginia Promissory Note is a legal document in which one party, known as the borrower or maker, promises to pay a specific amount of money to another party, referred to as the lender or payee, under agreed-upon terms. This document outlines the amount borrowed, the interest rate, the repayment schedule, and any other conditions related to the loan.

-

What are the key components of a Promissory Note?

A well-drafted Promissory Note typically includes:

- The names and addresses of both the borrower and the lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The repayment schedule, detailing when payments are due.

- Any late fees or penalties for missed payments.

- Conditions under which the lender can demand repayment.

-

Is a Promissory Note legally binding in Virginia?

Yes, a Promissory Note is legally binding in Virginia, provided it meets certain requirements. For the note to be enforceable, it must contain the essential elements of a contract, including an offer, acceptance, and consideration (something of value exchanged). Both parties must also have the legal capacity to enter into the agreement.

-

Do I need to have a lawyer draft my Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, it is highly advisable, especially for larger loans or complex agreements. A legal professional can ensure that the document complies with state laws and adequately protects your interests.

-

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is essential to document any modifications in writing and have both parties sign the amended agreement to avoid any disputes in the future.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make the required payments, the lender has the right to take legal action to recover the owed amount. This may involve sending a demand letter, initiating collection proceedings, or pursuing a lawsuit, depending on the terms outlined in the note and the specific circumstances of the default.

-

How is a Promissory Note different from a loan agreement?

While both documents serve to outline the terms of a loan, a Promissory Note is typically simpler and focuses solely on the borrower's promise to repay the loan. In contrast, a loan agreement is more comprehensive and may include additional terms such as collateral, covenants, and other obligations of the parties involved.

PDF Characteristics

| Fact Name | Details |

|---|---|

| Definition | A Virginia Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Virginia Promissory Note is governed by the Virginia Uniform Commercial Code (UCC), specifically Article 3, which deals with negotiable instruments. |

| Parties Involved | The note typically involves two parties: the borrower (maker) who promises to pay, and the lender (payee) who receives the payment. |

| Essential Elements | Key elements of the note include the amount owed, interest rate (if applicable), payment schedule, and signatures of both parties. |

| Enforceability | A properly executed Virginia Promissory Note is legally enforceable, meaning the lender can take legal action if the borrower defaults on payment. |