Attorney-Approved Transfer-on-Death Deed Document for the State of Virginia

In Virginia, the Transfer-on-Death Deed (TODD) offers a straightforward way for property owners to ensure their real estate passes directly to their chosen beneficiaries upon their death, avoiding the often lengthy and costly probate process. This deed allows individuals to retain full control over their property during their lifetime, as it does not take effect until the owner has passed away. The form requires specific information, including the legal description of the property and the names of the beneficiaries, which must be clearly stated to avoid any confusion. Importantly, the deed must be properly executed and recorded in the local land records office to be valid. This tool is particularly beneficial for those looking to simplify the transfer of property and provide peace of mind to their loved ones. As families navigate the complexities of estate planning, understanding the nuances of the Transfer-on-Death Deed can play a crucial role in ensuring a smooth transition of assets and minimizing potential disputes among heirs.

Consider More Transfer-on-Death Deed Templates for Different States

Transfer on Death Deed Form Florida - This form can be beneficial in avoiding disputes among heirs regarding property ownership.

When engaging in a boat transaction in California, it is important to utilize the California Boat Bill of Sale form to ensure all details are accurately recorded. This document not only facilitates the proof of sale but also aids in the clear transfer of ownership from one party to another. To further understand the requirements and process involved, you can refer to the Bill of Sale for a Boat for comprehensive guidance, ensuring that all parties are protected during the sale.

Transfer on Death Deed Tennessee Form - Provides clear instructions for the transfer of property upon death.

Dos and Don'ts

When filling out the Virginia Transfer-on-Death Deed form, it is important to follow certain guidelines to ensure the process goes smoothly. Here are four things you should and shouldn't do:

- Do ensure all property information is accurate and complete.

- Do include the names and addresses of all beneficiaries clearly.

- Don't forget to sign the deed in front of a notary public.

- Don't leave any sections blank; fill out every required field.

Virginia Transfer-on-Death Deed Sample

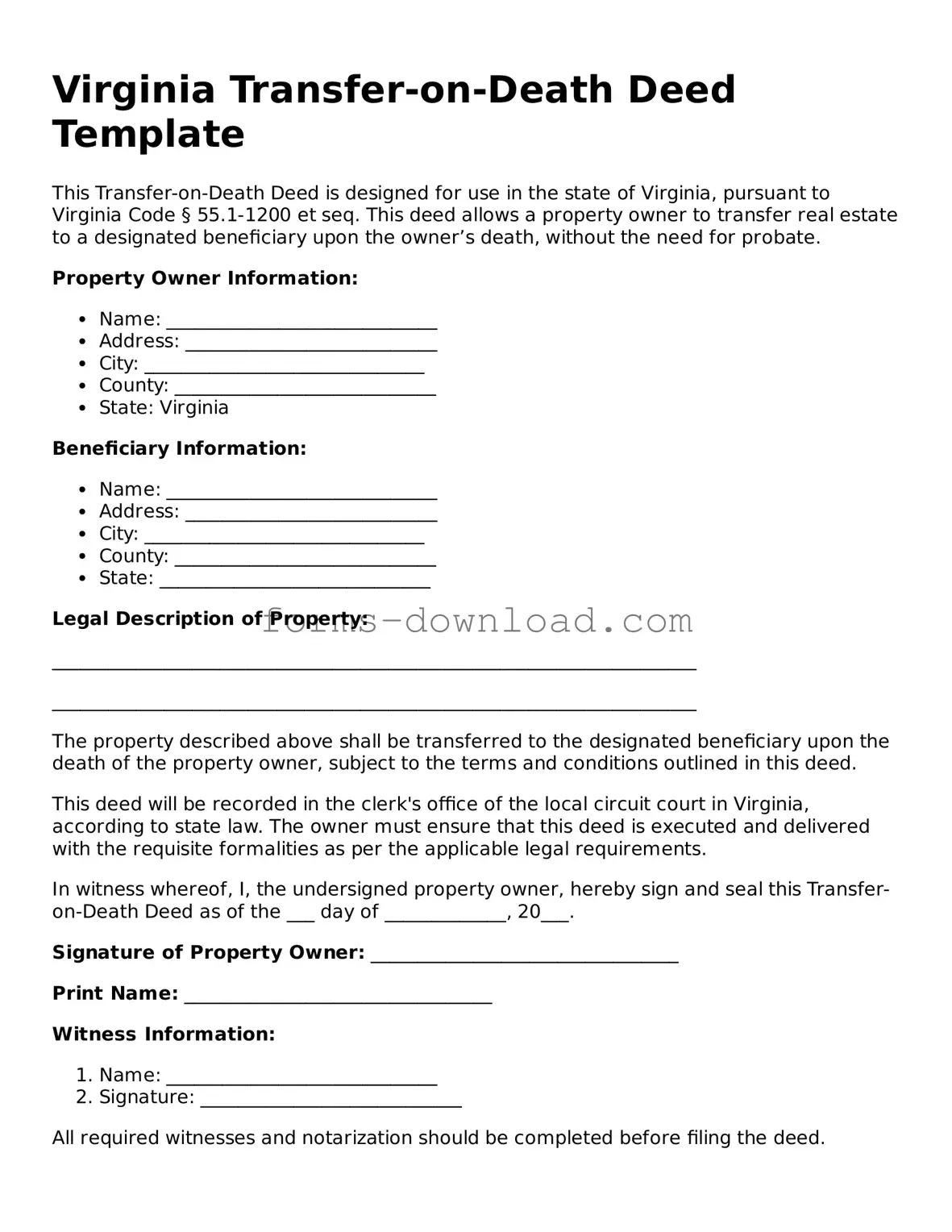

Virginia Transfer-on-Death Deed Template

This Transfer-on-Death Deed is designed for use in the state of Virginia, pursuant to Virginia Code § 55.1-1200 et seq. This deed allows a property owner to transfer real estate to a designated beneficiary upon the owner’s death, without the need for probate.

Property Owner Information:

- Name: _____________________________

- Address: ___________________________

- City: ______________________________

- County: ____________________________

- State: Virginia

Beneficiary Information:

- Name: _____________________________

- Address: ___________________________

- City: ______________________________

- County: ____________________________

- State: _____________________________

Legal Description of Property:

_____________________________________________________________________

_____________________________________________________________________

The property described above shall be transferred to the designated beneficiary upon the death of the property owner, subject to the terms and conditions outlined in this deed.

This deed will be recorded in the clerk's office of the local circuit court in Virginia, according to state law. The owner must ensure that this deed is executed and delivered with the requisite formalities as per the applicable legal requirements.

In witness whereof, I, the undersigned property owner, hereby sign and seal this Transfer-on-Death Deed as of the ___ day of _____________, 20___.

Signature of Property Owner: _________________________________

Print Name: _________________________________

Witness Information:

- Name: _____________________________

- Signature: ____________________________

All required witnesses and notarization should be completed before filing the deed.

For further assistance regarding this deed or its legal implications, consulting with a legal professional is advisable.

Listed Questions and Answers

-

What is a Transfer-on-Death Deed in Virginia?

A Transfer-on-Death Deed (TOD) is a legal document that allows a property owner to transfer real estate to a designated beneficiary upon the owner's death. This deed enables the owner to retain full control of the property during their lifetime, while ensuring that the property passes directly to the beneficiary without going through probate.

-

How do I create a Transfer-on-Death Deed?

To create a TOD deed in Virginia, you must complete the form with specific information, including your name, the beneficiary's name, and a legal description of the property. It is essential to sign the deed in front of a notary public. Once signed, the deed must be recorded in the local land records office where the property is located to be effective.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TOD deed at any time while you are still alive. To do this, you must create a new TOD deed or a revocation document. The new deed or revocation must also be signed and notarized, then recorded in the same local land records office where the original deed was recorded. This ensures that your intentions are clear and legally recognized.

-

What happens if the beneficiary dies before me?

If the beneficiary named in your TOD deed dies before you, the property will not automatically transfer to them. Instead, you may choose to designate a new beneficiary or allow the property to pass according to your will or Virginia's laws of intestate succession if you do not have a will. It is important to keep your beneficiary designations up to date to avoid complications.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a TOD deed. The property is not considered a gift until it transfers to the beneficiary upon your death. However, the beneficiary may be responsible for property taxes and any potential capital gains taxes when they sell the property. It is advisable to consult with a tax professional for specific guidance based on your situation.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Virginia Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Virginia Code § 64.2-620 through § 64.2-629. |

| Eligibility | Any individual who owns real estate in Virginia can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Revocation | The deed can be revoked by the property owner at any time before their death, ensuring flexibility. |

| Filing Requirements | The deed must be recorded in the local land records office where the property is located to be effective. |

| Tax Implications | Transferring property via a Transfer-on-Death Deed generally does not trigger gift taxes during the owner's lifetime. |

| Effectiveness | The deed only takes effect upon the death of the property owner, allowing for continued control during their lifetime. |