Attorney-Approved Promissory Note Document for the State of Washington

The Washington Promissory Note is a crucial document for anyone involved in lending or borrowing money within the state. This form outlines the borrower's promise to repay a specified amount to the lender, detailing the terms of the loan, including interest rates, payment schedules, and consequences for default. It serves as a legally binding agreement that protects both parties by clearly stating their rights and responsibilities. Important elements such as the loan amount, maturity date, and any collateral involved are typically included, ensuring transparency in the transaction. Additionally, the form may specify whether the note is secured or unsecured, impacting the lender's recourse in case of non-payment. Understanding the Washington Promissory Note is essential for ensuring that all parties are aware of their obligations and the legal implications of the agreement.

Consider More Promissory Note Templates for Different States

Arizona Promissory Note - It provides clarity and protection for both parties involved in the lending process.

When transferring ownership of a boat in Louisiana, it is important to utilize the appropriate documentation, and the Bill of Sale for a Boat is essential for ensuring a smooth transaction, as it contains all necessary details to validate the sale.

Loan Promissory Note - A promissory note serves as proof of a debt obligation.

Tennessee Promissory Note - It can play a key role in estate planning or lend to heirs.

Dos and Don'ts

When filling out the Washington Promissory Note form, it's important to follow some basic guidelines. Here are six things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Don't leave any required fields blank.

- Do write clearly and legibly to avoid confusion.

- Don't use abbreviations unless they are standard terms.

- Do double-check all numbers and dates for accuracy.

- Don't sign the document until all parties are present.

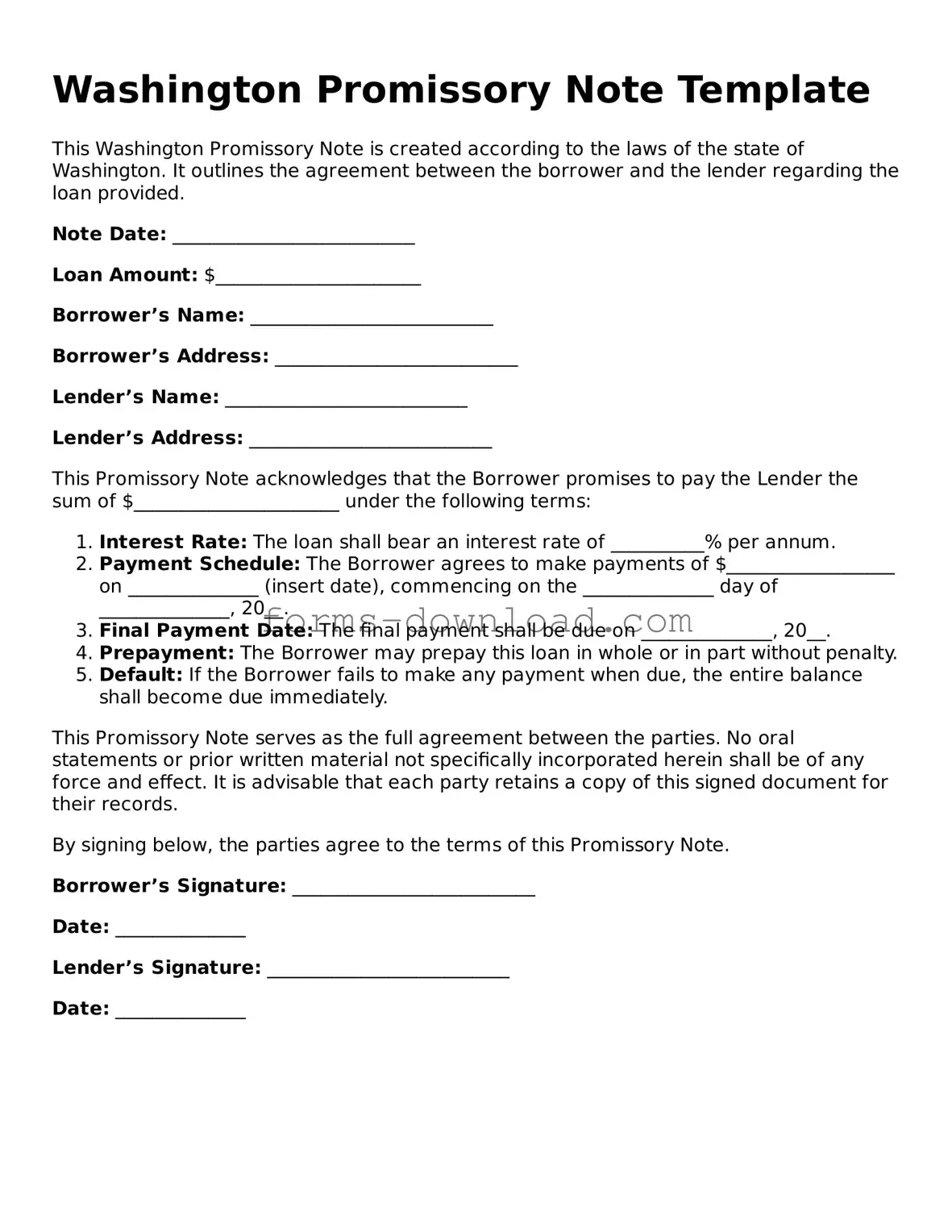

Washington Promissory Note Sample

Washington Promissory Note Template

This Washington Promissory Note is created according to the laws of the state of Washington. It outlines the agreement between the borrower and the lender regarding the loan provided.

Note Date: __________________________

Loan Amount: $______________________

Borrower’s Name: __________________________

Borrower’s Address: __________________________

Lender’s Name: __________________________

Lender’s Address: __________________________

This Promissory Note acknowledges that the Borrower promises to pay the Lender the sum of $______________________ under the following terms:

- Interest Rate: The loan shall bear an interest rate of __________% per annum.

- Payment Schedule: The Borrower agrees to make payments of $__________________ on ______________ (insert date), commencing on the ______________ day of ______________, 20__.

- Final Payment Date: The final payment shall be due on ______________, 20__.

- Prepayment: The Borrower may prepay this loan in whole or in part without penalty.

- Default: If the Borrower fails to make any payment when due, the entire balance shall become due immediately.

This Promissory Note serves as the full agreement between the parties. No oral statements or prior written material not specifically incorporated herein shall be of any force and effect. It is advisable that each party retains a copy of this signed document for their records.

By signing below, the parties agree to the terms of this Promissory Note.

Borrower’s Signature: __________________________

Date: ______________

Lender’s Signature: __________________________

Date: ______________

Listed Questions and Answers

-

What is a Washington Promissory Note?

A Washington Promissory Note is a written agreement in which one party promises to pay a specific amount of money to another party at a defined future date or on demand. This document outlines the terms of the loan, including the interest rate, payment schedule, and any penalties for late payments.

-

Who can use a Washington Promissory Note?

Any individual or business in Washington can use a Promissory Note. It is commonly used for personal loans, business loans, or any situation where one party lends money to another. Both the lender and borrower should be clear on the terms to avoid misunderstandings.

-

What information is required in a Washington Promissory Note?

A typical Promissory Note should include:

- The names and addresses of the borrower and lender

- The principal amount of the loan

- The interest rate (if applicable)

- The repayment schedule

- Any late fees or penalties

- Signatures of both parties

-

Is it necessary to notarize a Washington Promissory Note?

No, it is not legally required to notarize a Promissory Note in Washington. However, having it notarized can provide additional legal protection and can help verify the identities of the parties involved.

-

What happens if the borrower defaults on the loan?

If the borrower fails to make payments as agreed, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or pursuing collections. It’s important for both parties to understand the consequences of defaulting before entering into the agreement.

-

Can a Washington Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement to ensure clarity and enforceability.

-

How long is a Washington Promissory Note valid?

The validity of a Promissory Note generally depends on the statute of limitations for written contracts in Washington, which is typically six years. After this period, the lender may lose the right to enforce the note in court.

-

What should I do if I lose my Promissory Note?

If a Promissory Note is lost, the lender should be notified immediately. A replacement note may be issued, but both parties must agree on the terms. It’s also a good idea to keep a copy of the original note in a safe place to prevent future issues.

-

Are there any specific laws governing Promissory Notes in Washington?

Yes, Promissory Notes in Washington are governed by state laws and the Uniform Commercial Code (UCC). It’s important for both lenders and borrowers to be aware of these regulations to ensure compliance and protect their rights.

-

Where can I find a template for a Washington Promissory Note?

Templates for Washington Promissory Notes can be found online through legal websites, or you may consult with a legal professional to create a customized note that meets your specific needs.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Washington Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a defined time. |

| Governing Law | The Washington Promissory Note is governed by the Revised Code of Washington (RCW) Title 62A, which covers the Uniform Commercial Code. |

| Form Requirements | The note must include essential elements such as the principal amount, interest rate, maturity date, and signatures of the parties involved. |

| Enforceability | To be enforceable, the note must be in writing and signed by the borrower. Oral agreements are generally not sufficient. |