Attorney-Approved Transfer-on-Death Deed Document for the State of Washington

The Washington Transfer-on-Death Deed form serves as a vital tool for individuals looking to simplify the transfer of real estate upon their death. This legal document allows property owners to designate a beneficiary who will automatically receive the property, bypassing the often lengthy and costly probate process. By completing this form, individuals can maintain control over their property during their lifetime while ensuring a seamless transition to their chosen heir. The form requires specific information, including the names of the property owner and beneficiary, a legal description of the property, and the signatures of the parties involved. It is important to note that the deed must be recorded with the county auditor to be effective. Additionally, the Transfer-on-Death Deed can be revoked or modified at any time before the owner's death, offering flexibility and peace of mind. Understanding these key aspects can empower property owners in Washington to make informed decisions about their estate planning.

Consider More Transfer-on-Death Deed Templates for Different States

Transfer on Death Deed Form Florida - This form is often used for homes, land, and other types of real estate assets.

In addition to ensuring legal protection during the sale, the Indiana Boat Bill of Sale form is essential for documenting the transaction details. For those looking to make the process easier, it's recommended to utilize the Bill of Sale for a Boat to ensure that all necessary information is captured accurately and efficiently.

What Are the Disadvantages of a Transfer on Death Deed? - Setting up a Transfer-on-Death Deed can help clarify your wishes regarding property distribution.

Dos and Don'ts

When filling out the Washington Transfer-on-Death Deed form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of what you should and shouldn’t do.

- Do ensure you are eligible to use the Transfer-on-Death Deed.

- Do provide accurate and complete information about the property.

- Do include the names and addresses of all beneficiaries clearly.

- Do sign the deed in front of a notary public.

- Do file the deed with the county auditor's office where the property is located.

- Don't leave any sections of the form blank.

- Don't use vague descriptions of the property.

- Don't forget to check for any local regulations that may affect the deed.

- Don't assume that verbal agreements with beneficiaries are sufficient.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is completed correctly and effectively. This can provide peace of mind for you and your beneficiaries.

Washington Transfer-on-Death Deed Sample

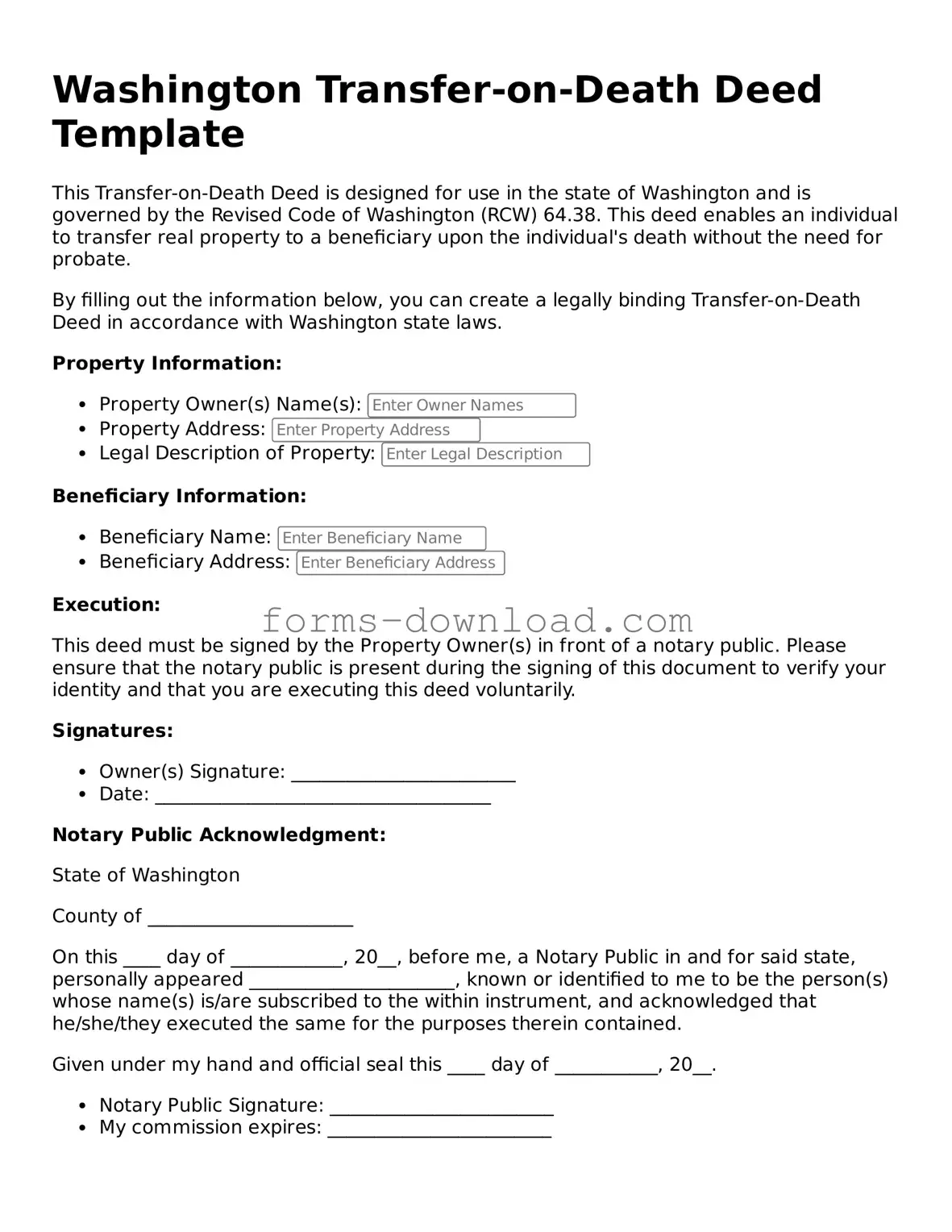

Washington Transfer-on-Death Deed Template

This Transfer-on-Death Deed is designed for use in the state of Washington and is governed by the Revised Code of Washington (RCW) 64.38. This deed enables an individual to transfer real property to a beneficiary upon the individual's death without the need for probate.

By filling out the information below, you can create a legally binding Transfer-on-Death Deed in accordance with Washington state laws.

Property Information:

- Property Owner(s) Name(s):

- Property Address:

- Legal Description of Property:

Beneficiary Information:

- Beneficiary Name:

- Beneficiary Address:

Execution:

This deed must be signed by the Property Owner(s) in front of a notary public. Please ensure that the notary public is present during the signing of this document to verify your identity and that you are executing this deed voluntarily.

Signatures:

- Owner(s) Signature: ________________________

- Date: ____________________________________

Notary Public Acknowledgment:

State of Washington

County of ______________________

On this ____ day of ____________, 20__, before me, a Notary Public in and for said state, personally appeared ______________________, known or identified to me to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

Given under my hand and official seal this ____ day of ___________, 20__.

- Notary Public Signature: ________________________

- My commission expires: ________________________

Note: It is advisable to consult with a legal professional to ensure that this deed is properly executed and that it complies with all applicable laws.

Listed Questions and Answers

-

What is a Transfer-on-Death Deed in Washington?

A Transfer-on-Death Deed (TOD) is a legal document that allows a property owner to transfer real estate to a designated beneficiary upon their death. This deed enables the property owner to retain full control of the property during their lifetime while ensuring a smooth transition of ownership after they pass away.

-

How does a Transfer-on-Death Deed work?

When the property owner dies, the property automatically transfers to the beneficiary named in the deed without the need for probate. This means that the beneficiary can take possession of the property immediately, without the delays and costs often associated with the probate process.

-

What are the benefits of using a Transfer-on-Death Deed?

- It avoids probate, saving time and money.

- The property owner retains control of the property during their lifetime.

- It can simplify the transfer process for heirs.

-

Are there any limitations to a Transfer-on-Death Deed?

Yes, there are some limitations. For instance, the deed cannot be used for certain types of property, such as property held in a trust or property that is subject to a mortgage that requires immediate payment upon death. Additionally, the deed must be properly executed and recorded to be valid.

-

How do I create a Transfer-on-Death Deed?

To create a TOD deed, the property owner must fill out the appropriate form, which includes details about the property and the beneficiary. After signing the deed, it must be recorded with the county auditor's office where the property is located. It is advisable to consult with a legal professional to ensure that the deed is completed correctly.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, a property owner can change or revoke a Transfer-on-Death Deed at any time during their lifetime. This can be done by completing a new deed that either names a different beneficiary or explicitly revokes the previous deed. It is important to properly record any changes to ensure they are legally recognized.

PDF Characteristics

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed (TOD) allows property owners in Washington to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Washington Transfer-on-Death Deed is governed by Washington Revised Code (RCW) 64.38. |

| Eligibility | Any individual who owns real estate in Washington can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the deed, allowing them to inherit the property directly. |

| Revocability | The Transfer-on-Death Deed can be revoked or changed at any time by the property owner during their lifetime. |

| Filing Requirements | The deed must be recorded with the county auditor in the county where the property is located to be effective. |

| Impact on Taxes | Using a Transfer-on-Death Deed does not affect property taxes during the owner's lifetime. |

| Exclusions | Transfer-on-Death Deeds cannot be used for certain types of property, such as property held in a trust or jointly owned property. |

| Legal Assistance | While not required, consulting with an attorney can help ensure the deed is completed correctly and meets all legal requirements. |